Personal Tax Scenario

Comprehensive net cash results calculated with bleeding-edge tax ratesDeliver superb results to every client, every time, quickly and easily!

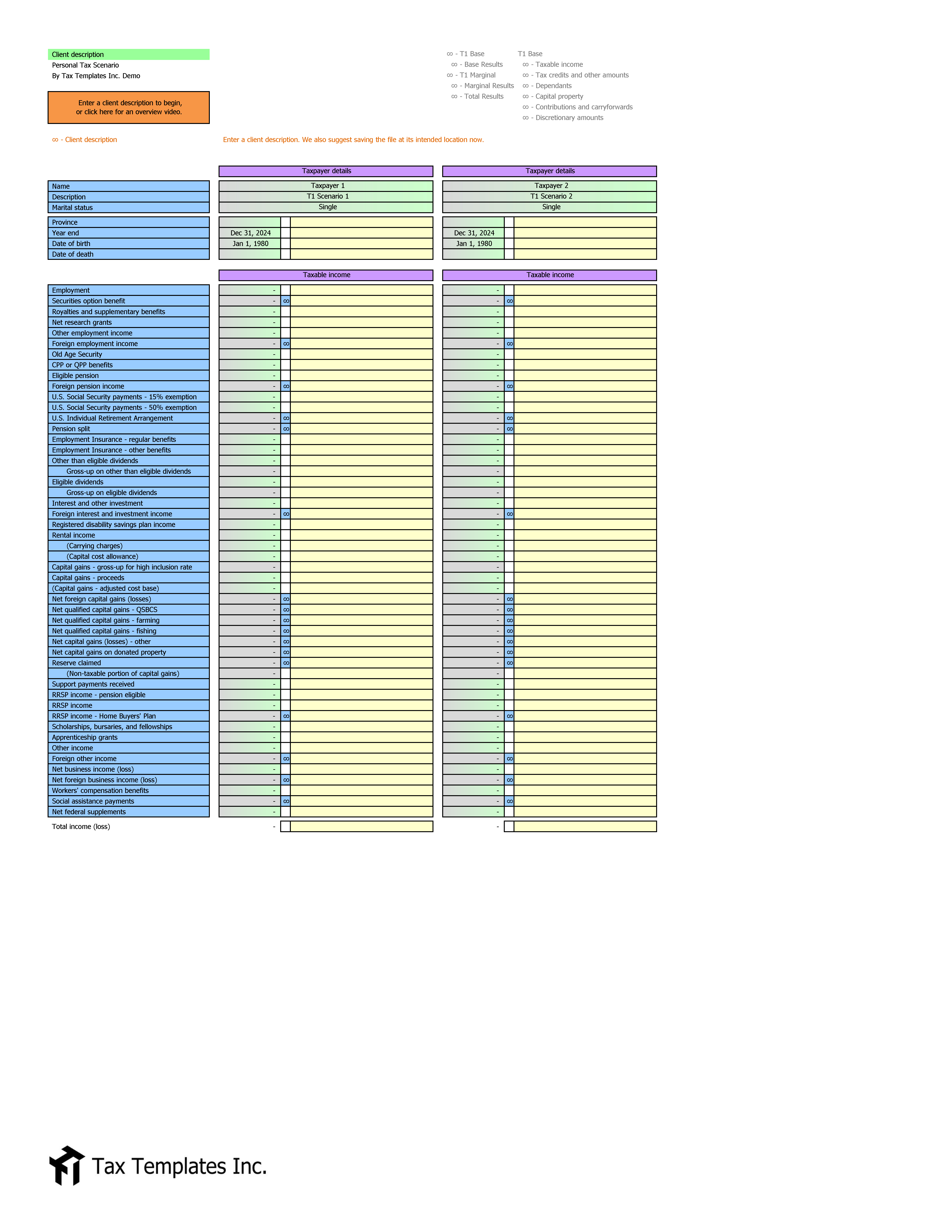

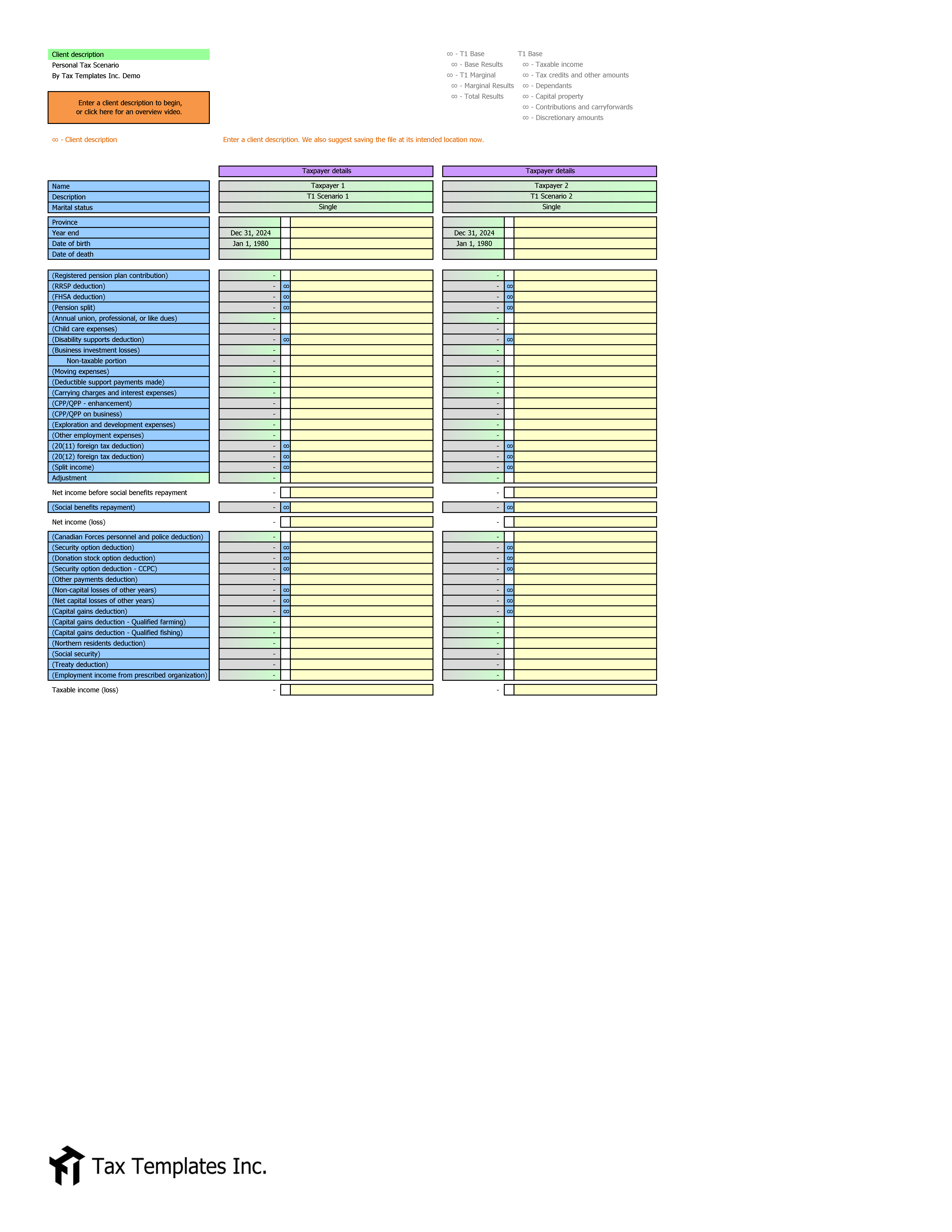

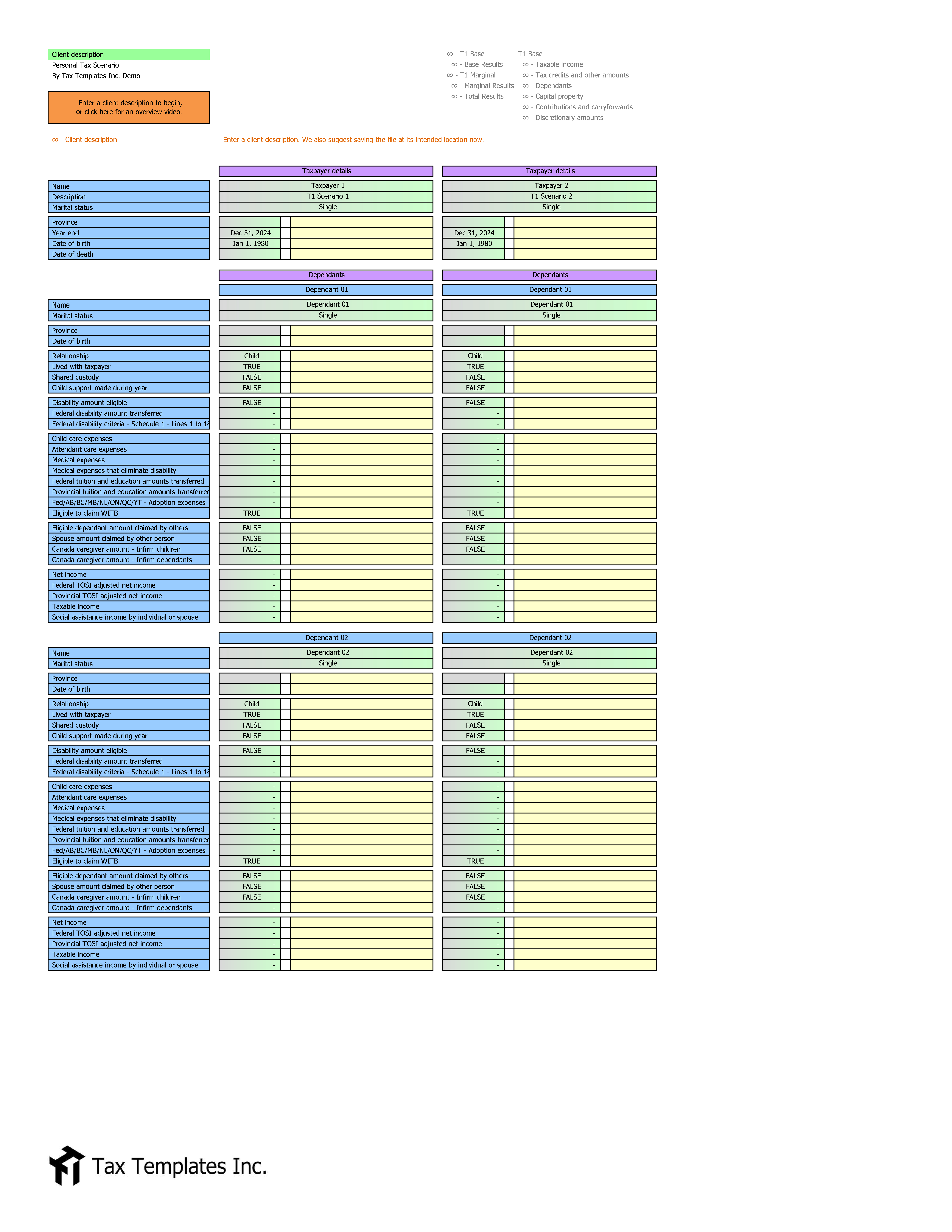

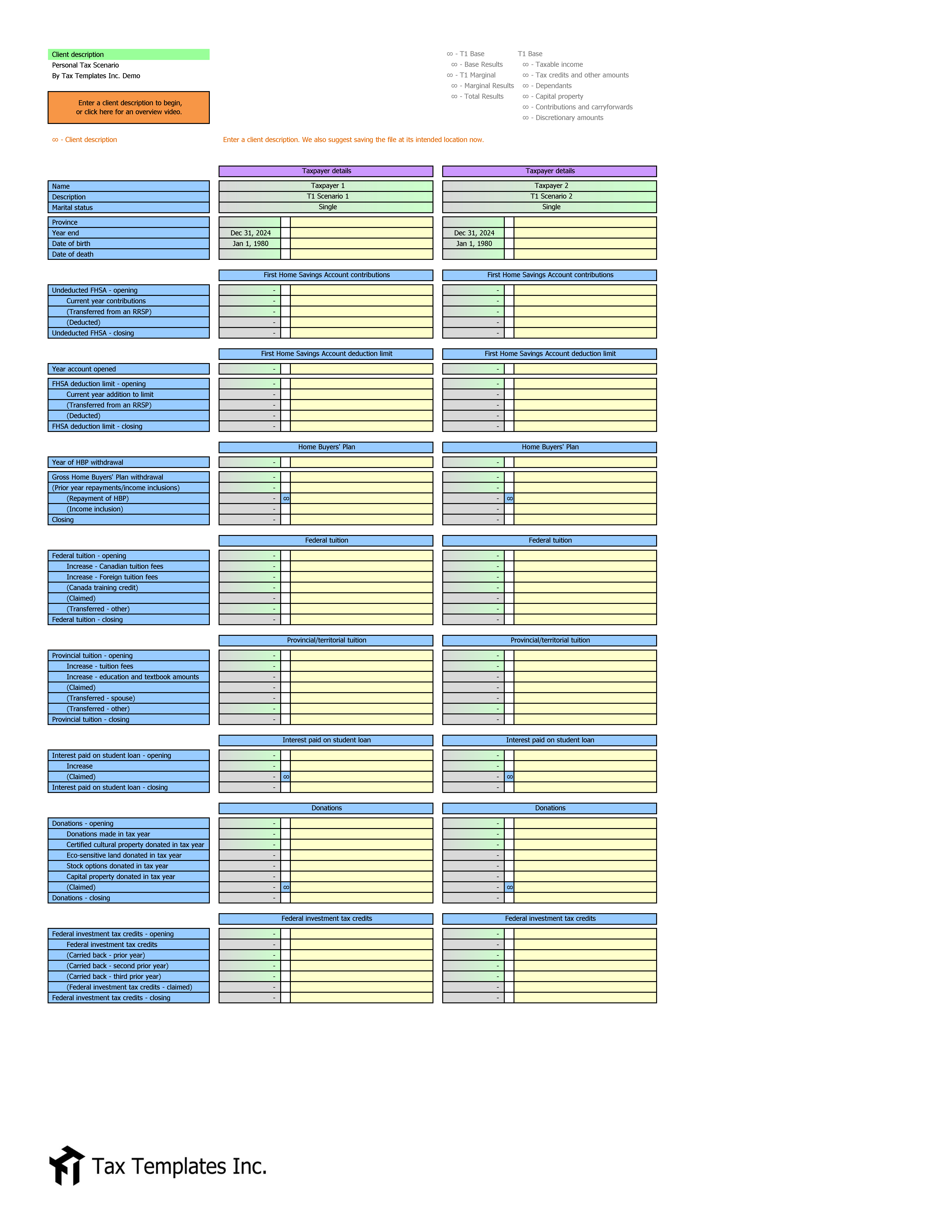

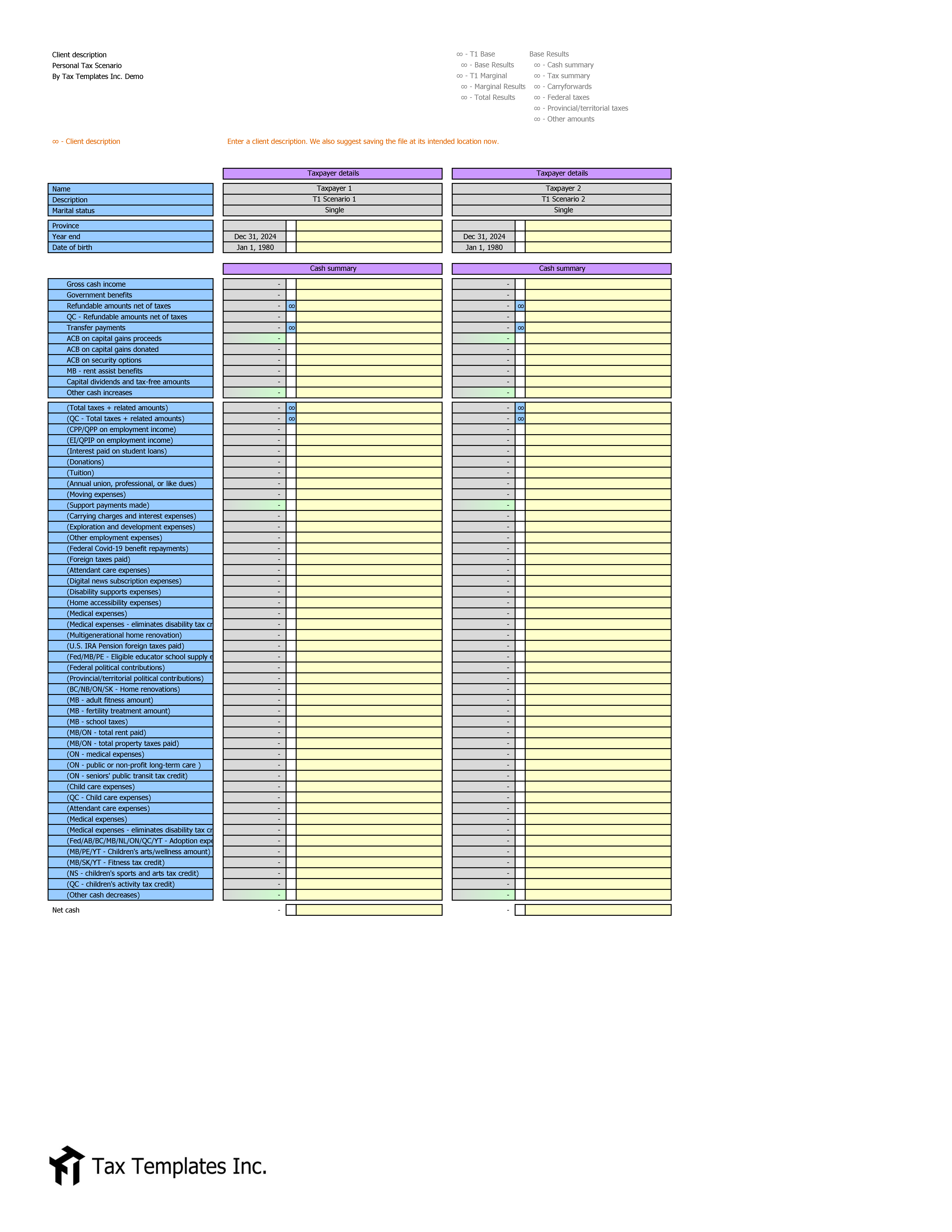

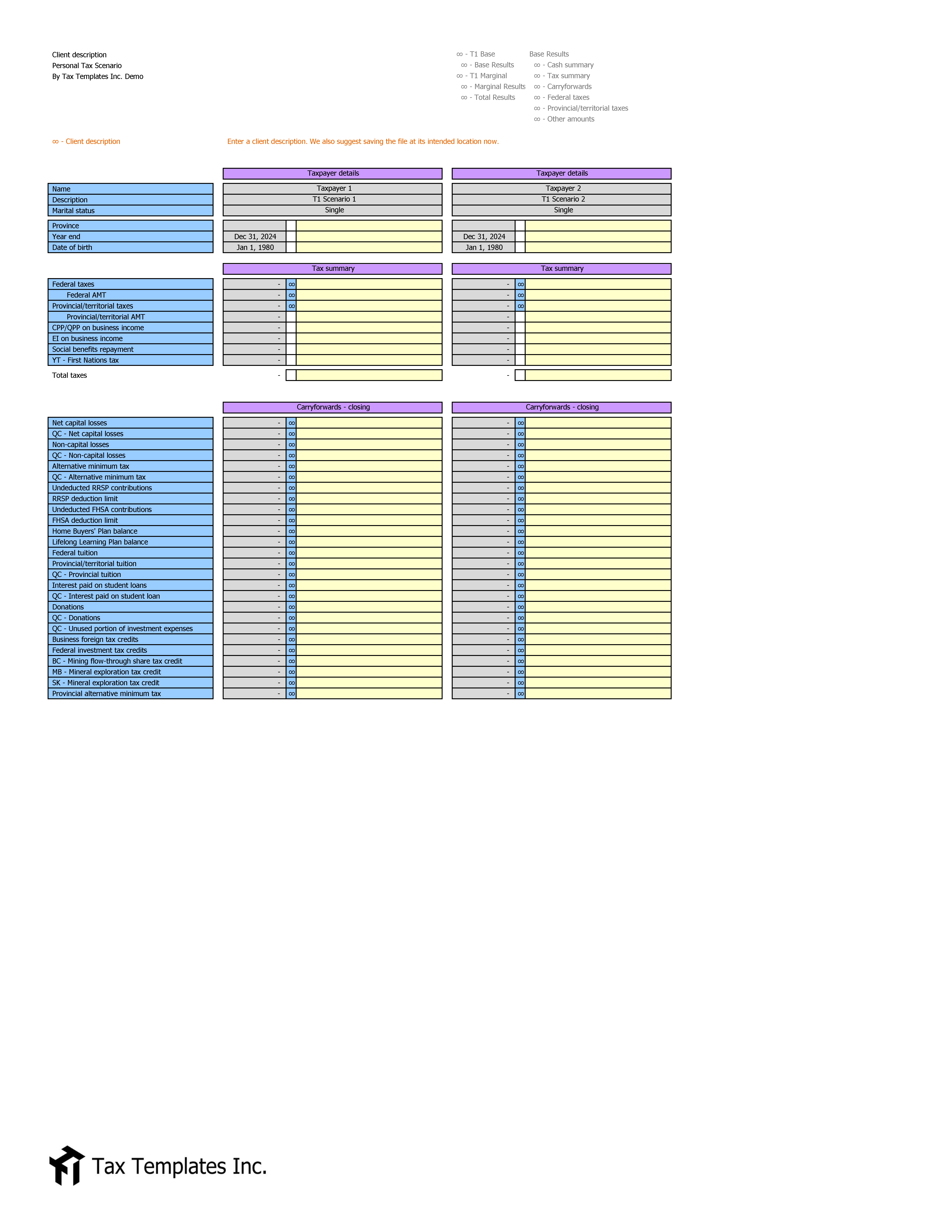

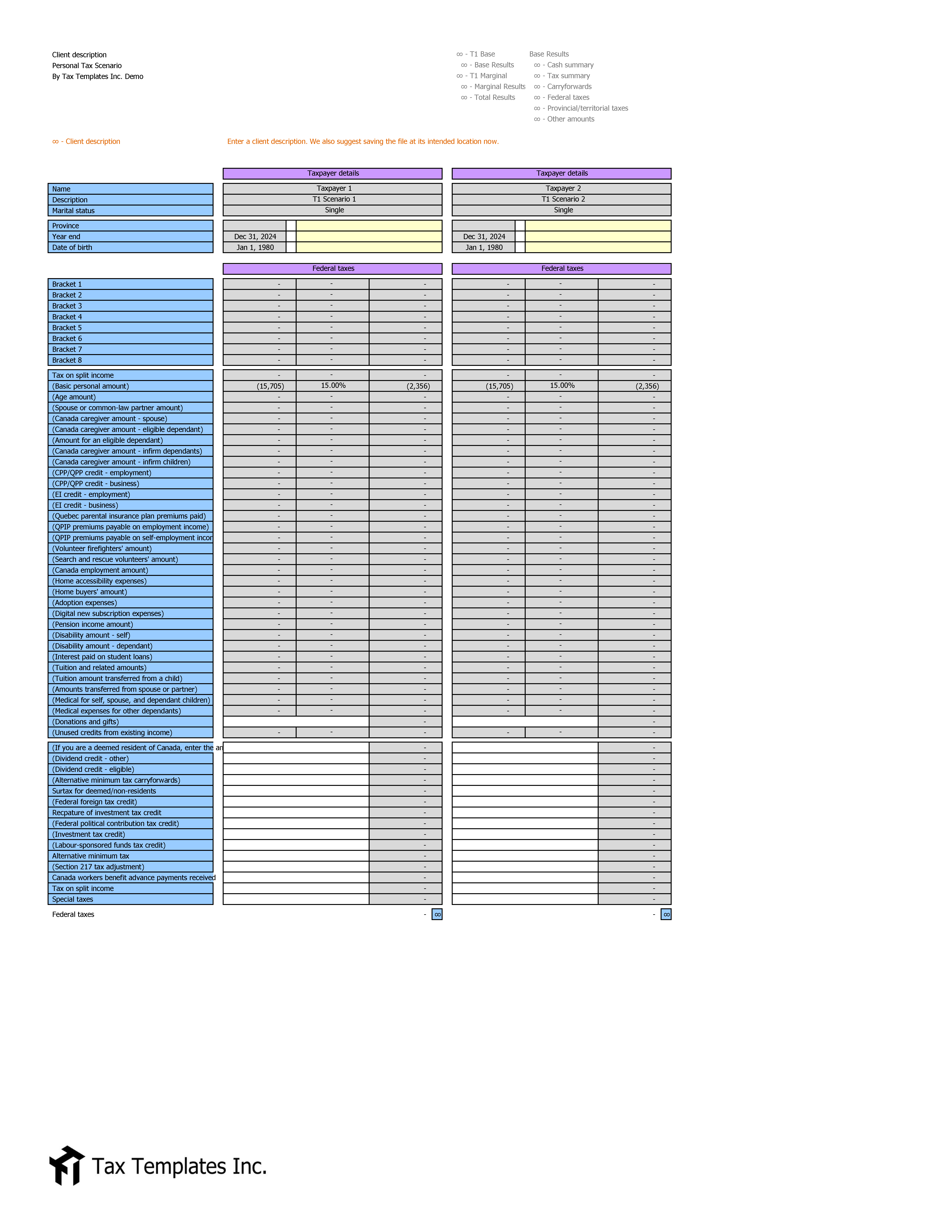

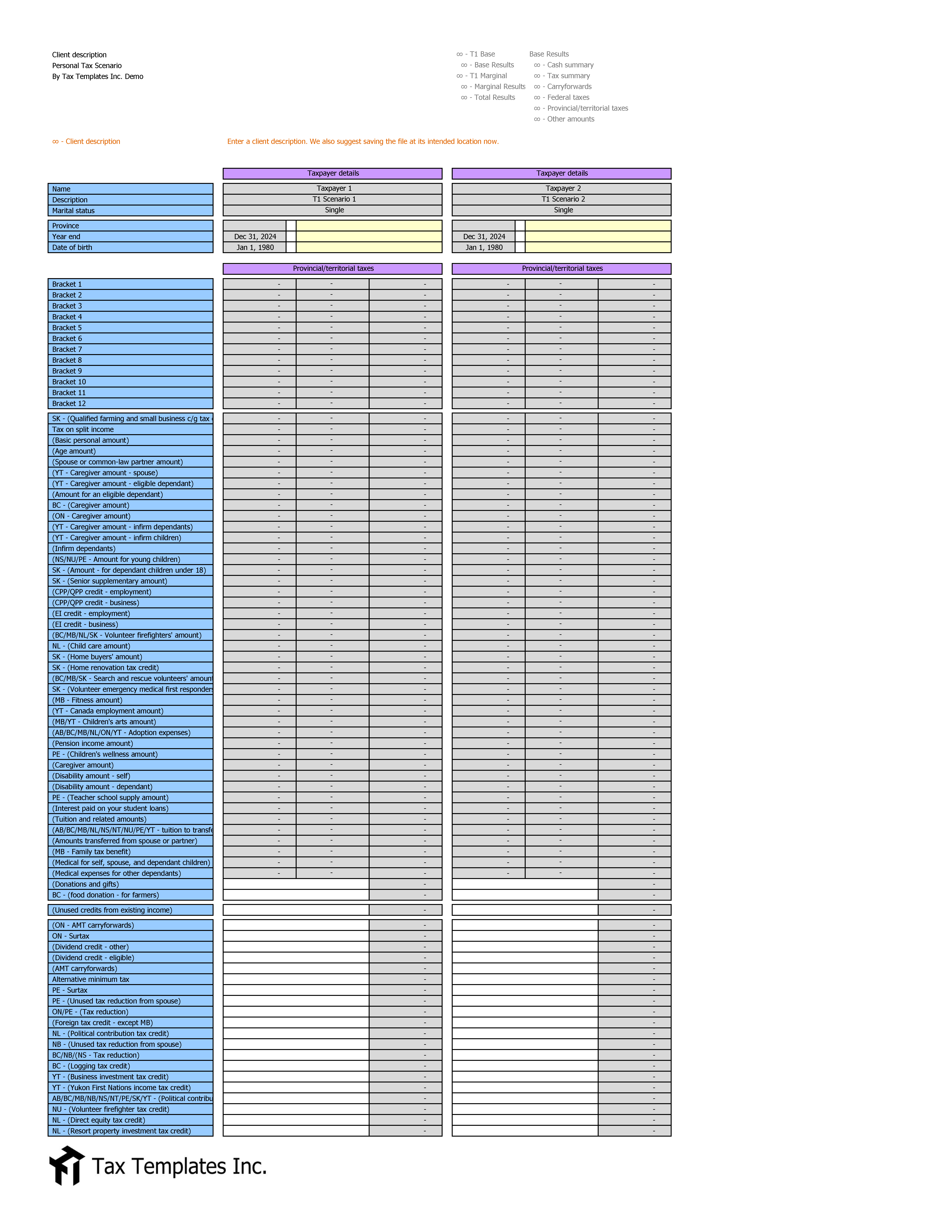

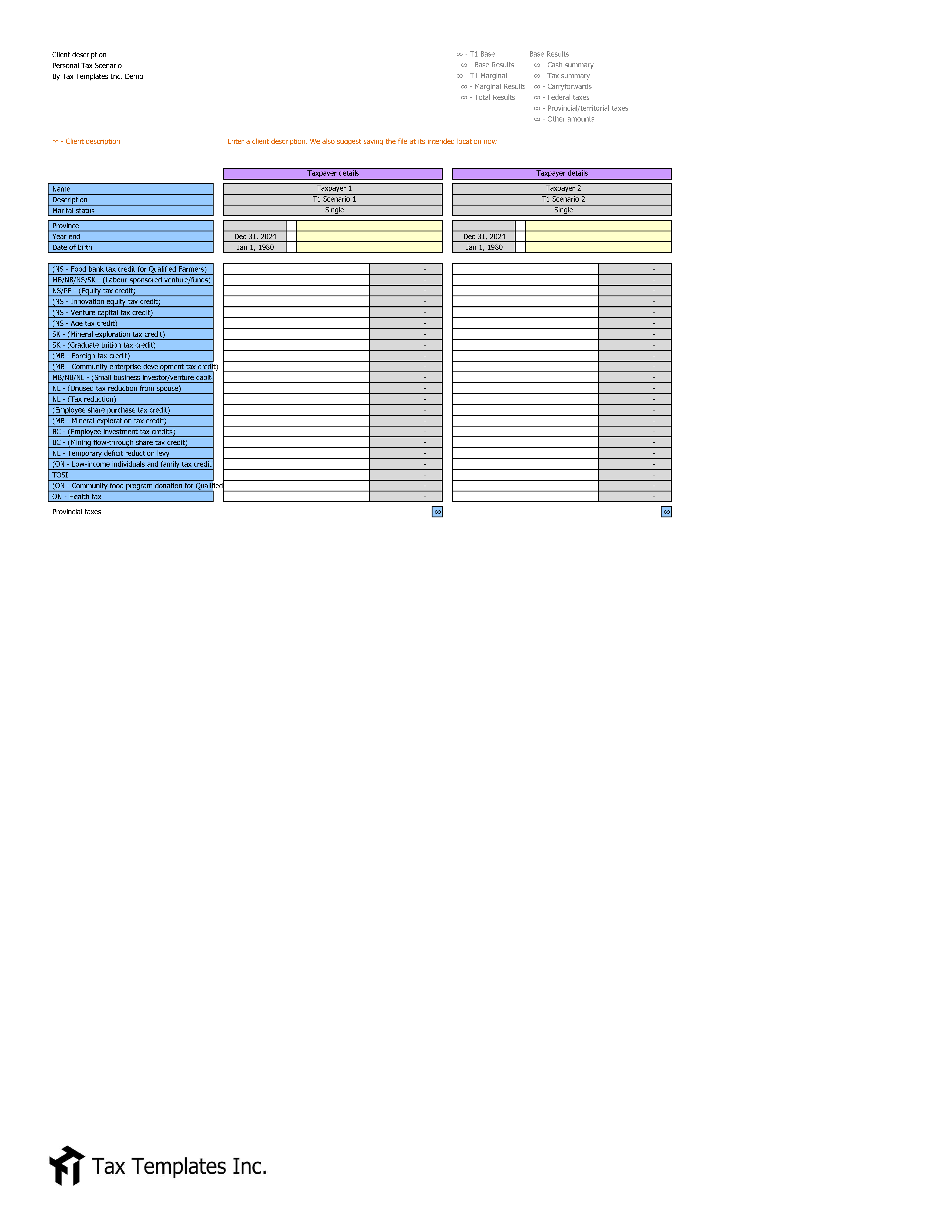

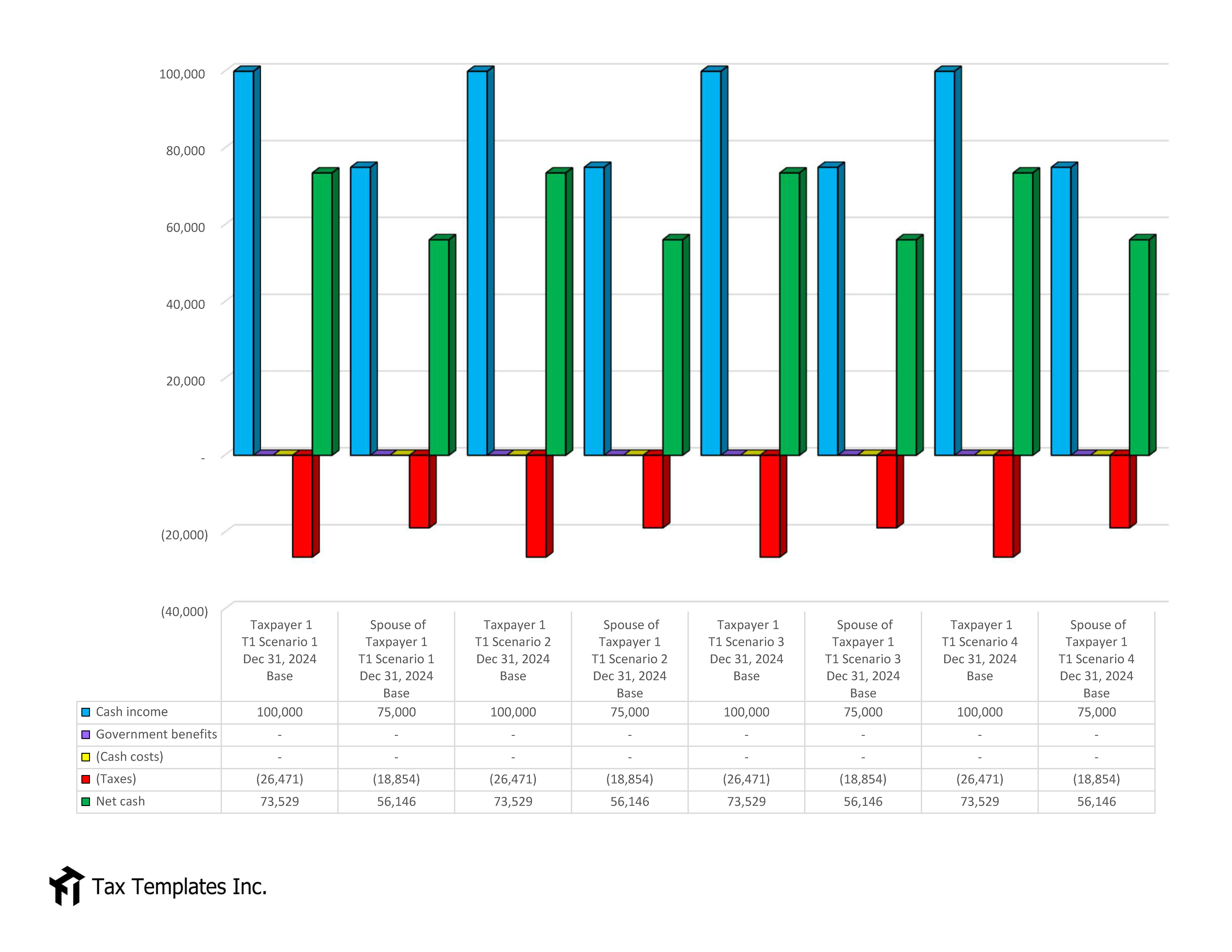

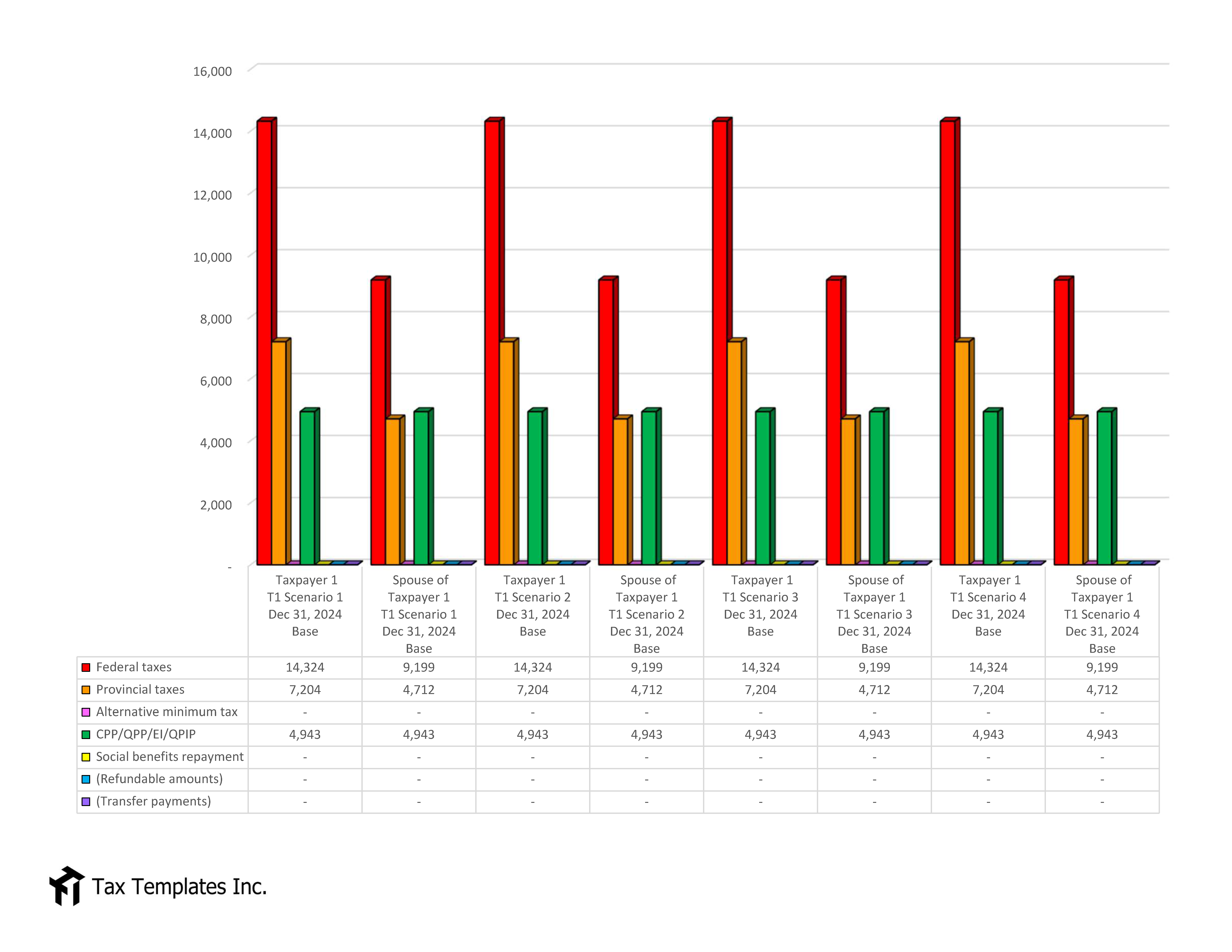

TTI’s Personal Tax Scenario worksheet projects the tax effects of income, deduction, and tax credit situations and determines after tax amounts.

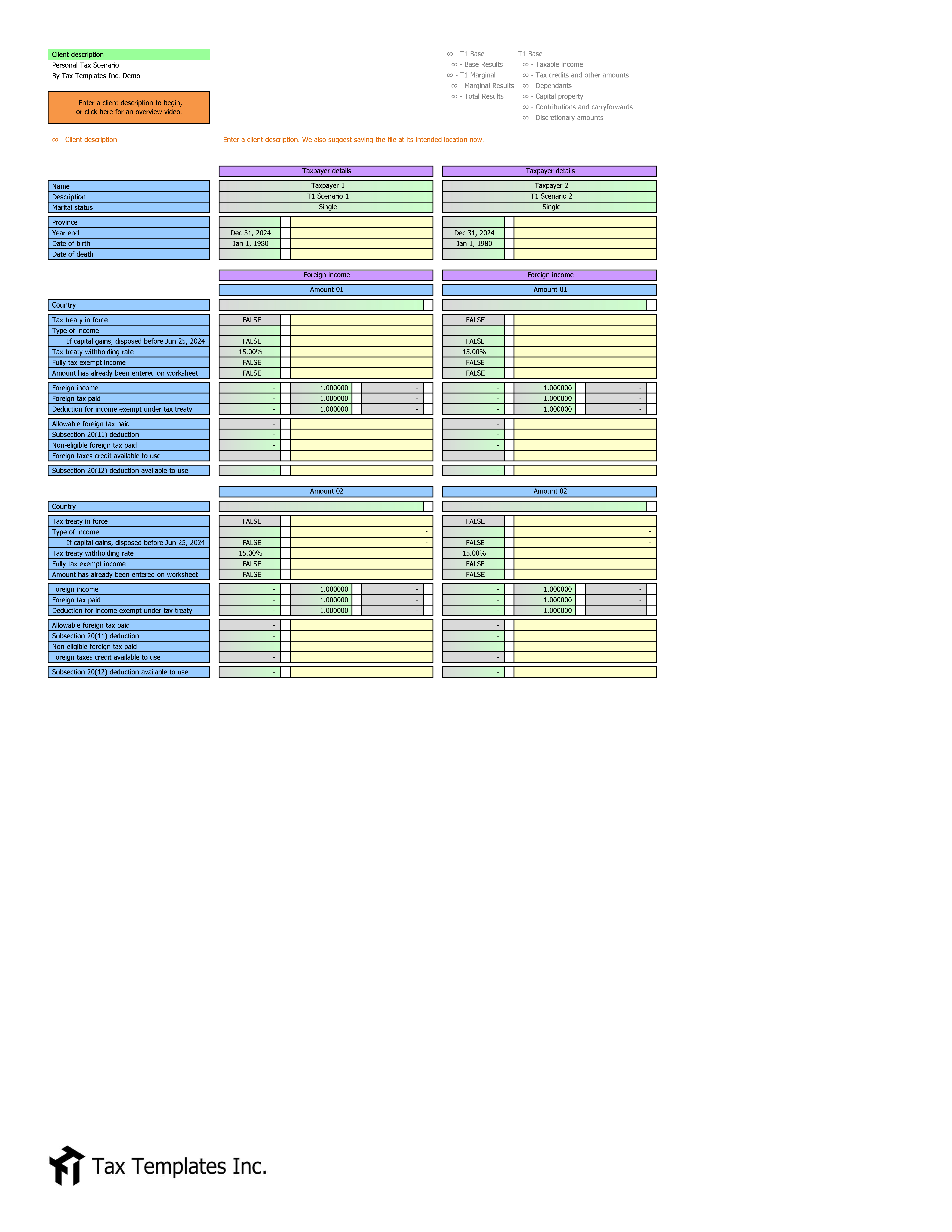

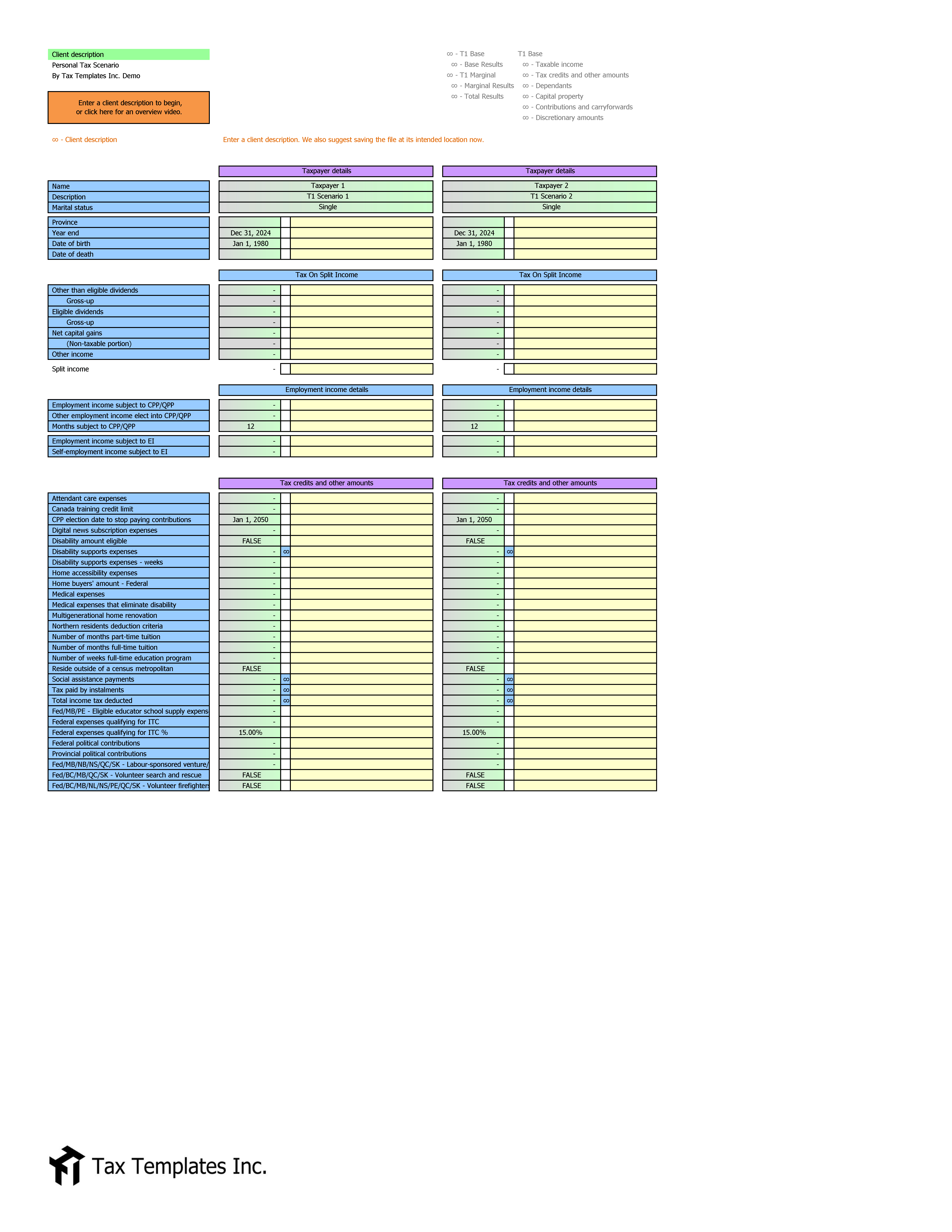

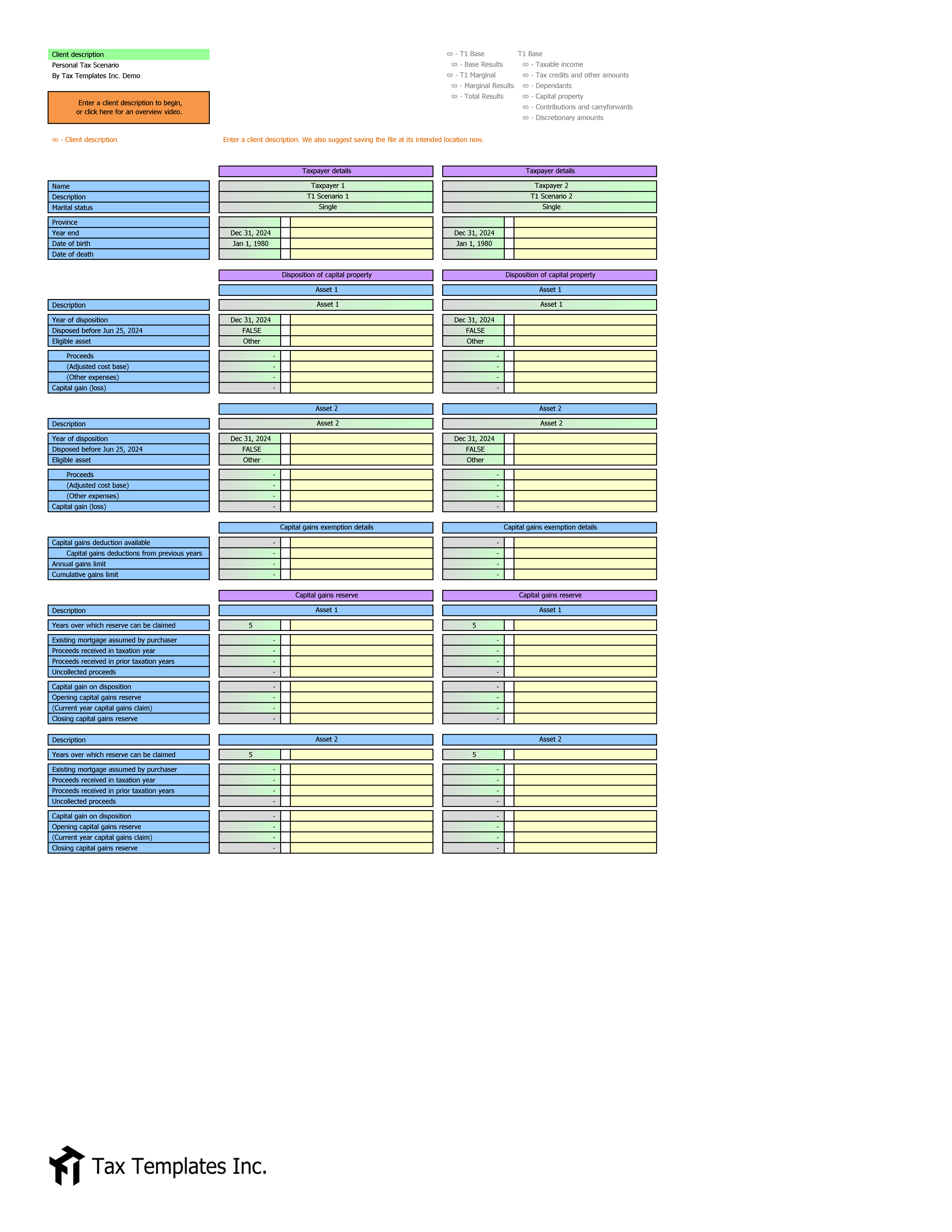

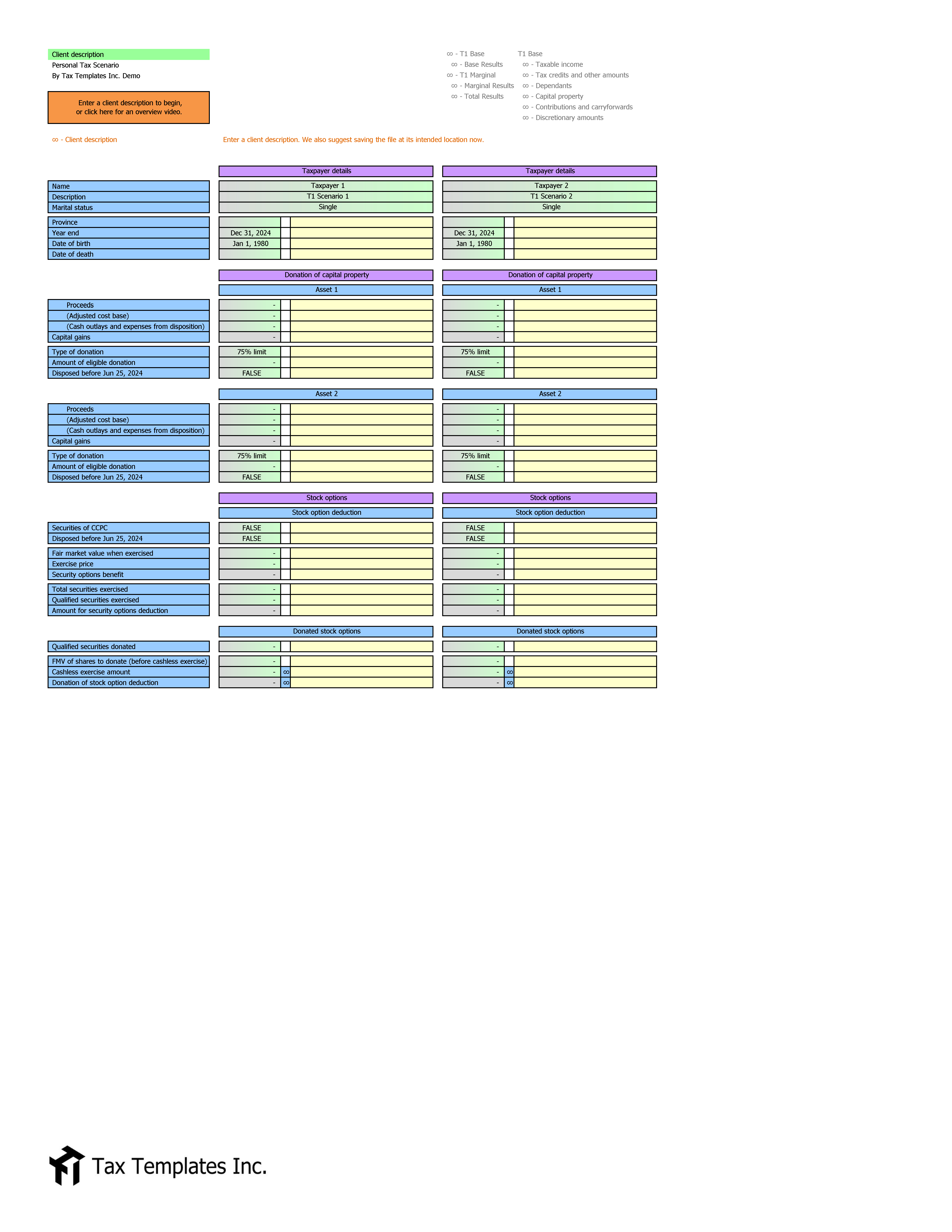

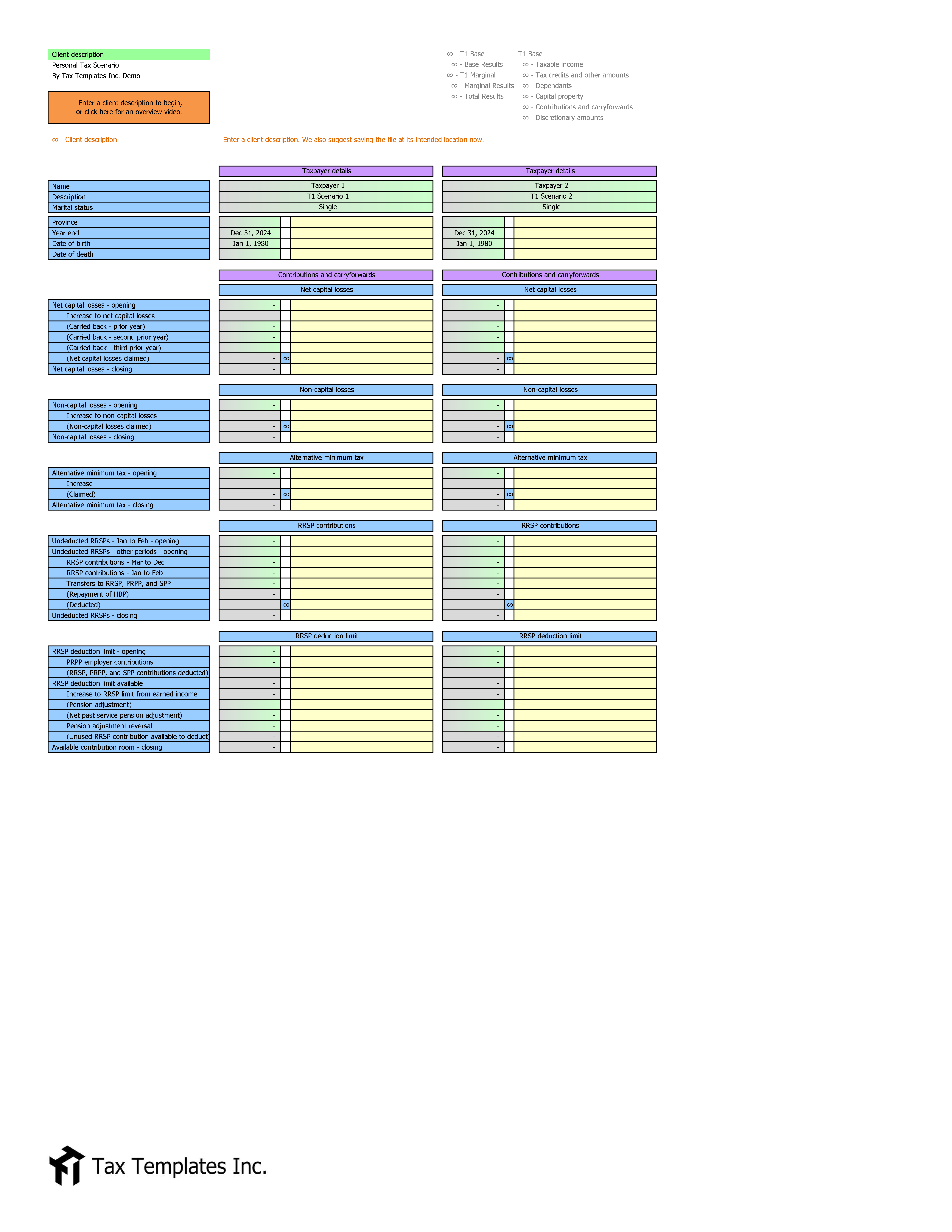

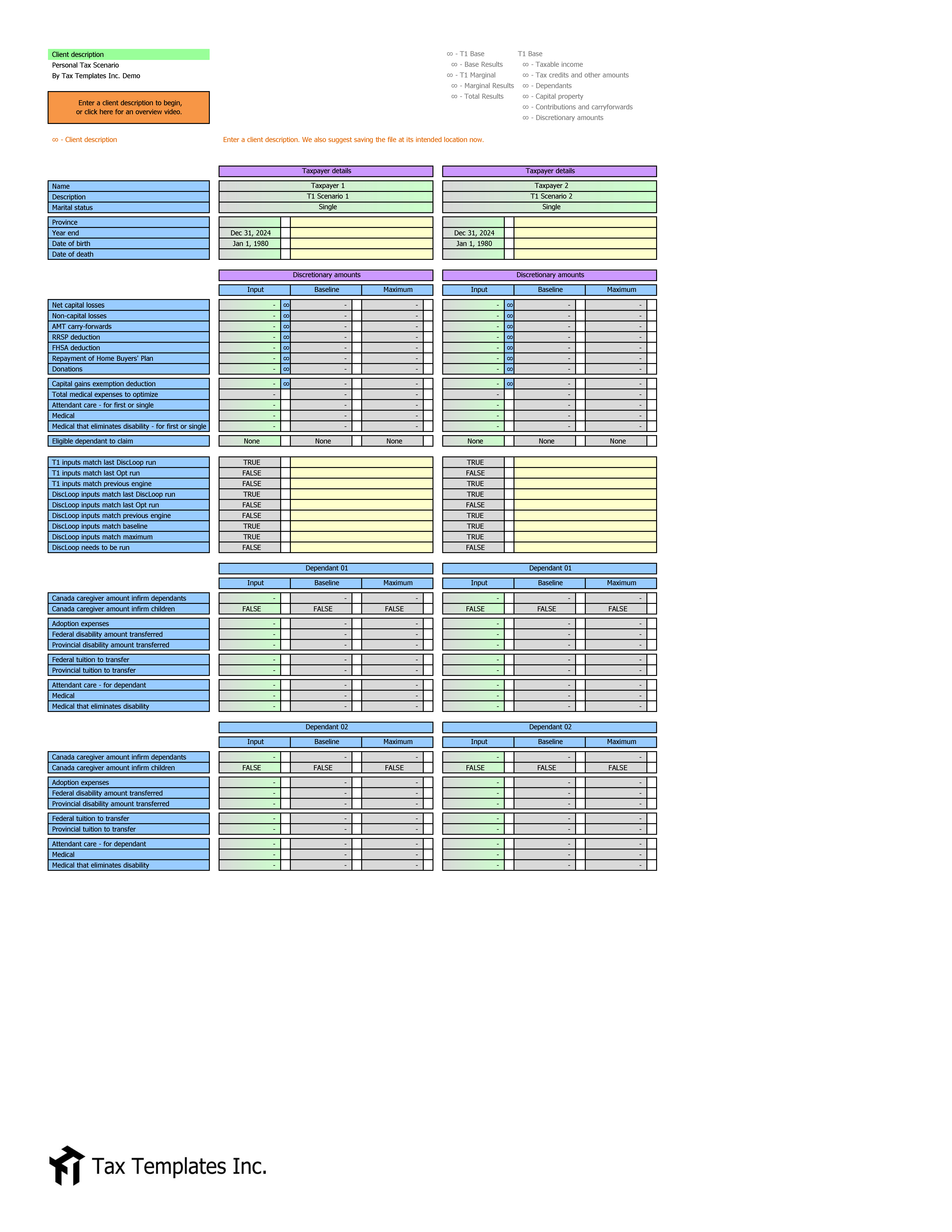

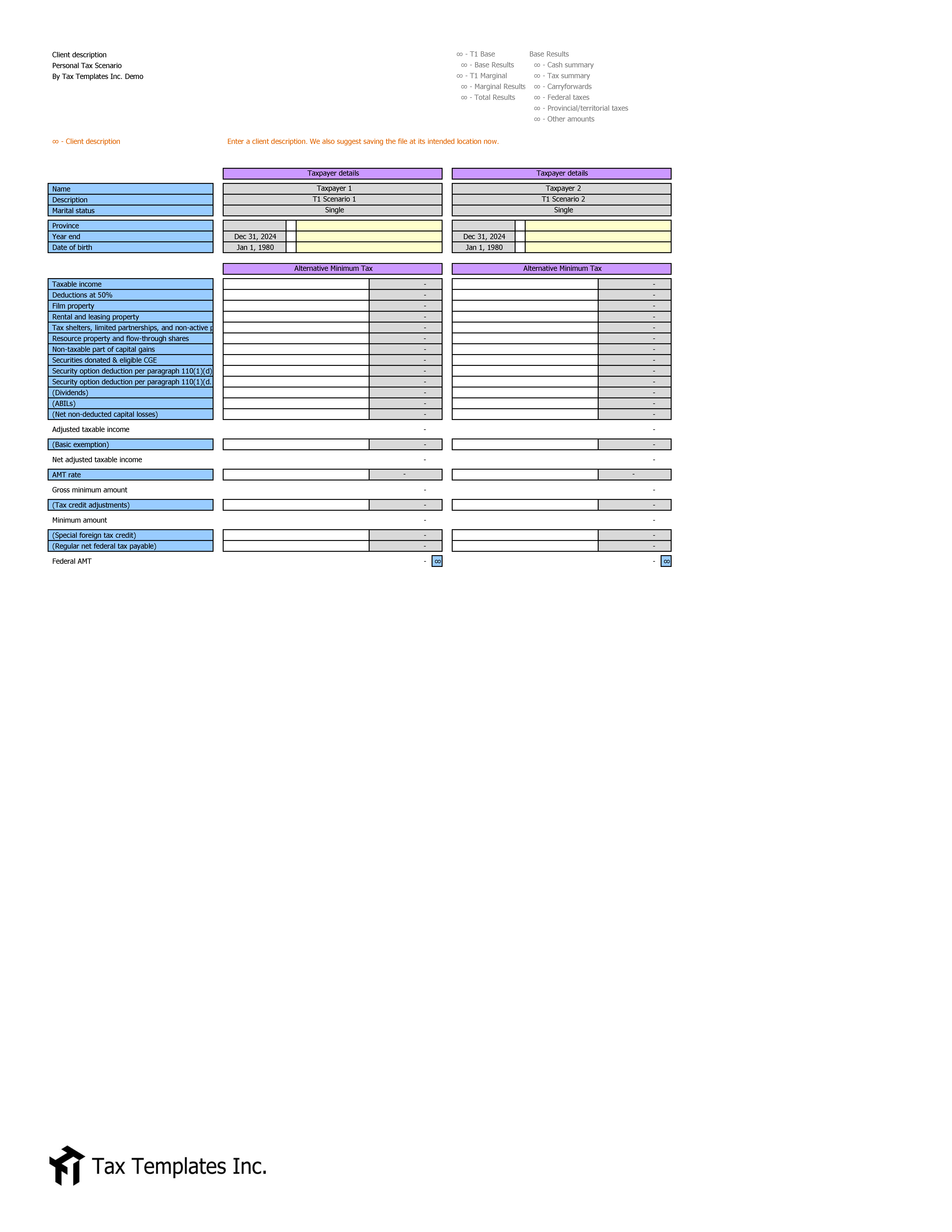

TTI’s robust tax engines support a comprehensive list of total and marginal incomes, deductions, non-refundable credits, refundable credits, transfer payments, and more. Complex elements such as TOSI, AMT, Capital Gains Exemptions, Foreign Income and Foreign Tax Credits, Donations, and much more are supported.

Leverage TTI’s Goal Seek function that will quickly answer practical questions, such as how much income needed to cover expenses, how much to withdraw before OAS is clawed back, or how much dividend income is needed to consume an AMT carry-forward.

Other highlights include:

- New 2/3 capital gains inclusion rate effective June 25, 2024 (video)

- New AMT calculations for 2024+

- New Canadian Entrepreneurs’ Incentive calculations

- Indexed 2025 rates and credits

- Updates from 2024 Federal and provincial budgets

- First Home Savings Account

- Projected tax rates through to 2032

- Discretionary amounts optimizer

- Eight side-by-side tax engines

- Support for up to six dependants

- Complete Federal and provincial transfer payments

- Provincial refundable credits

- Multiple branded charts highlights results

- Written reports to explain scenario outcomes

Personal Tax Scenario packages also include TTI’s Prescribed Loan worksheet, which determines the benefits of income splitting.