Safe Income

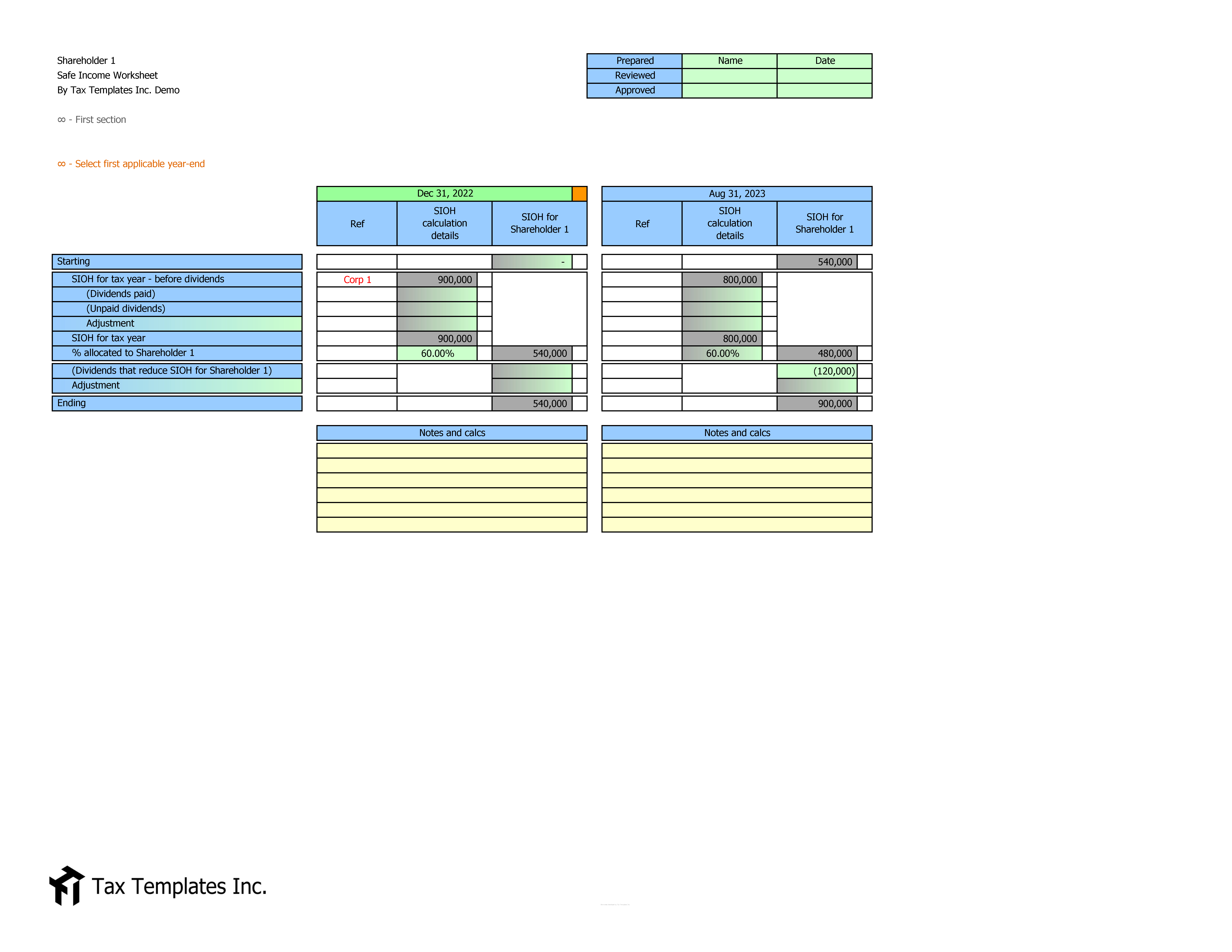

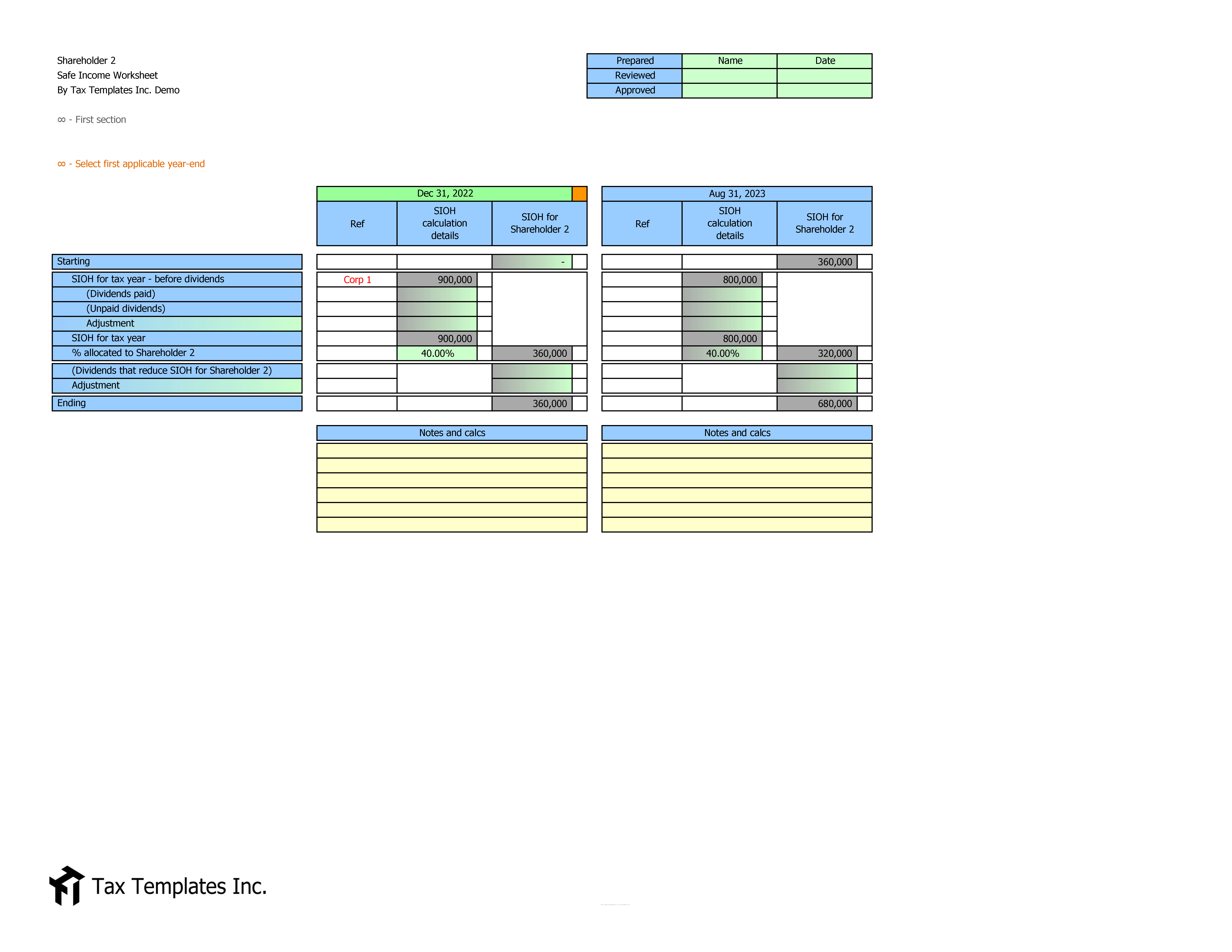

TTI sets the standard for reliable and easy to use Safe Income calculationsTTI’s Safe Income worksheet calculates the safe income on hand for a class of shares and allocates this balance to corporate shareholders.

Our fresh approach allows you to reconcile your adjustments to tax returns and financial statements. You have easy options to customize your solution in response to changing legislation, CRA policies, and court opinions.

The worksheet features:

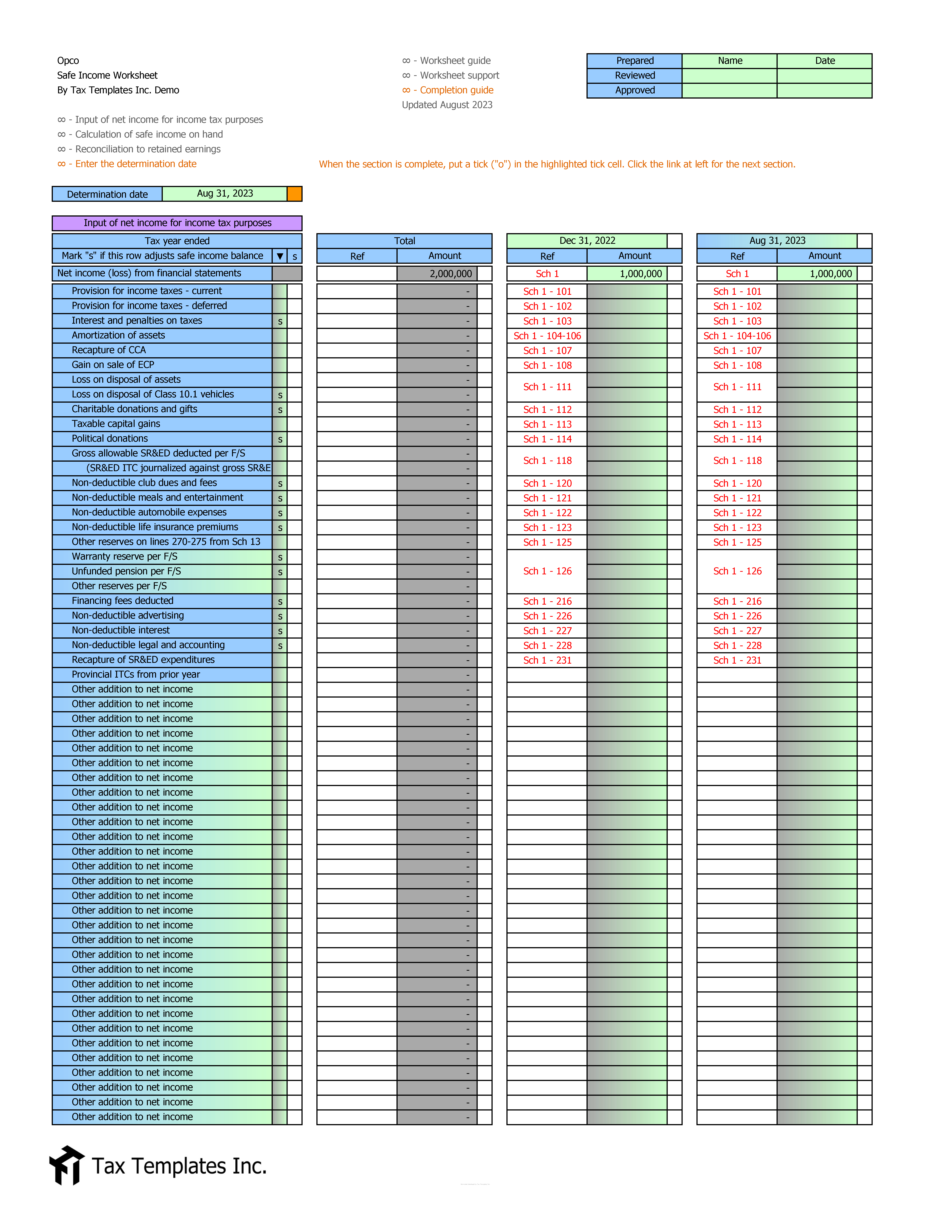

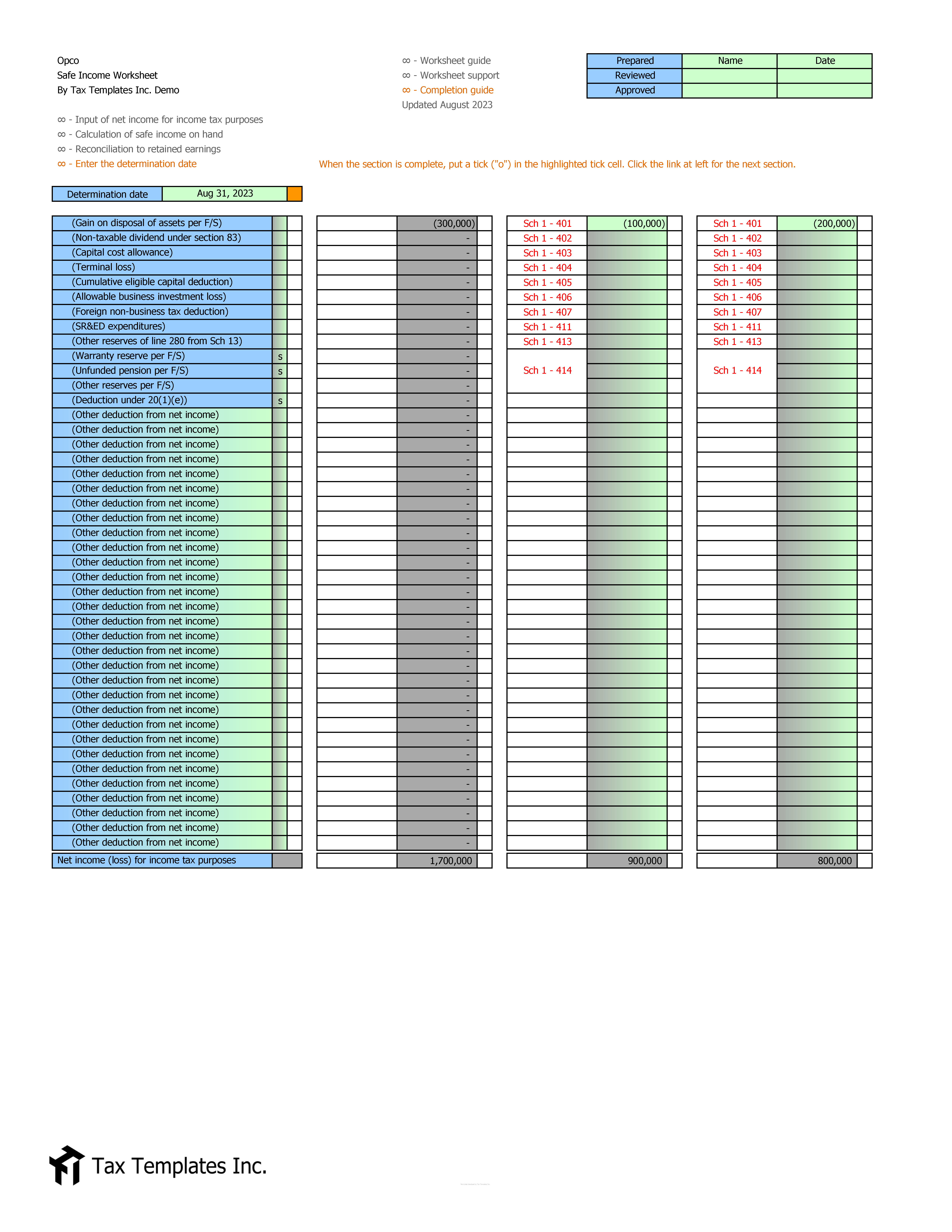

- Supports tax yearends since 1972

- Tax return references for reliable inputs

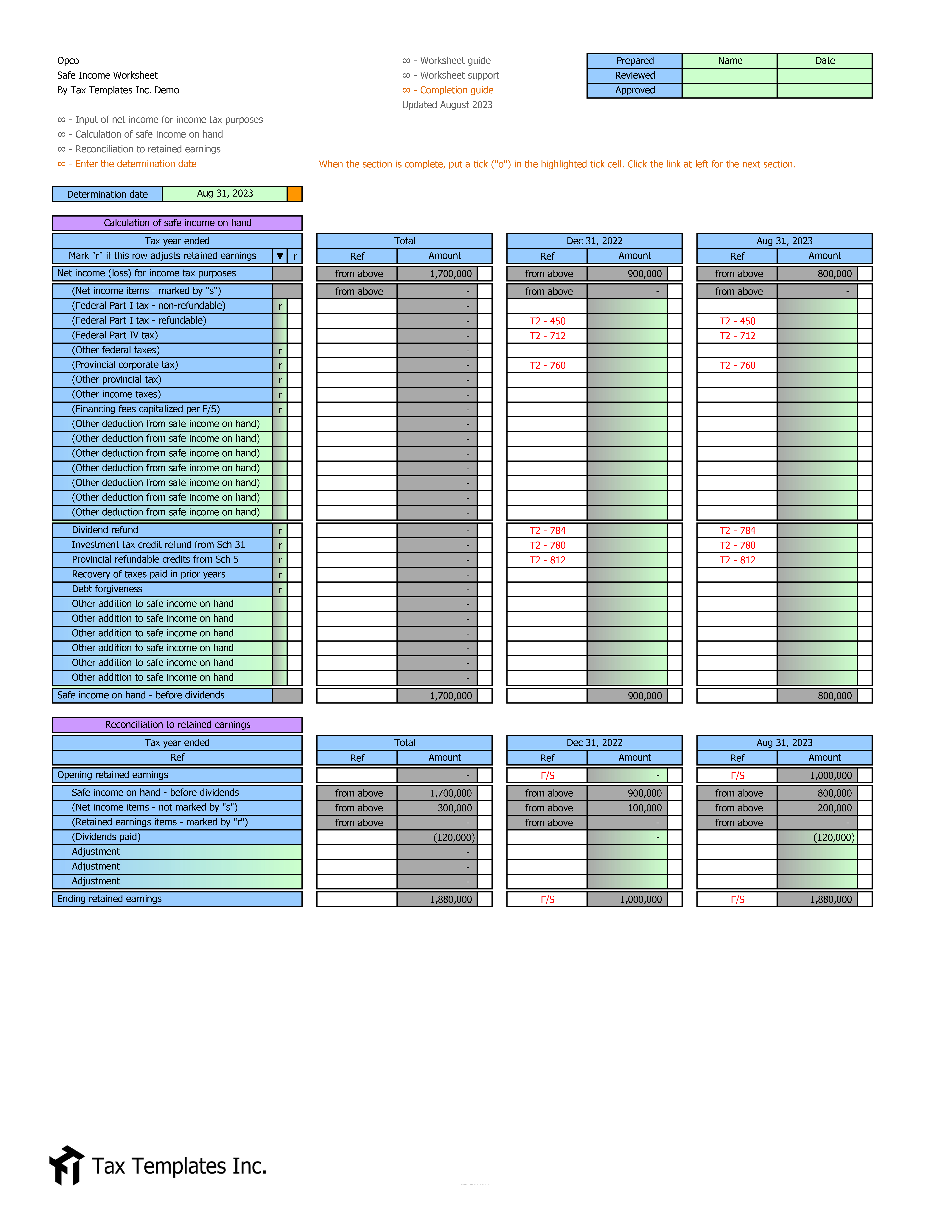

- Reconciliation to the T2 Tax Return

- Reconciliation to financial statements (retained earnings)

- Pre-populated safe income adjustments

- Calculation support for SR&ED adjustments

- Flexible adjustments to support unique scenarios

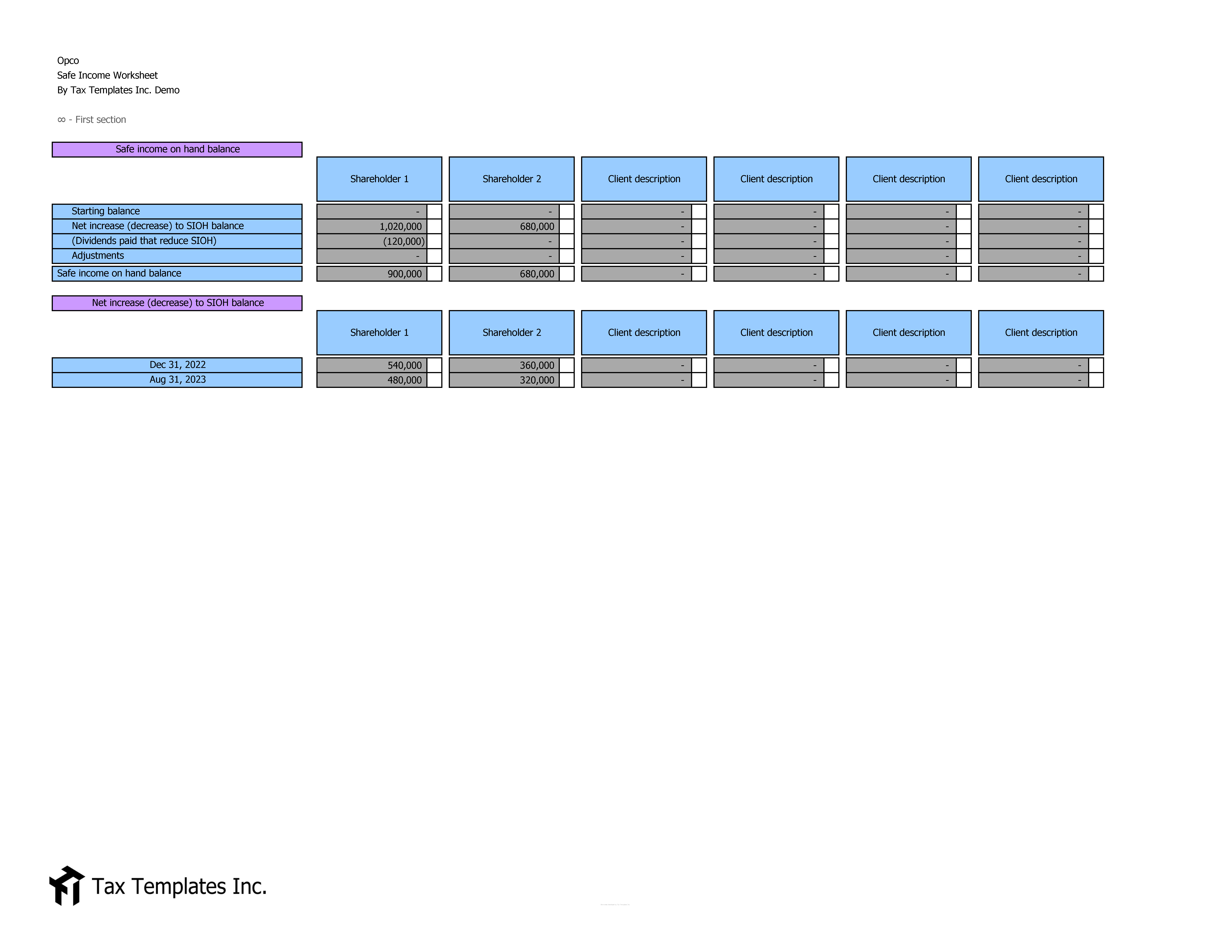

- Support for up to 32 shareholders

- Flexibility to select different corporate year-end to start calculations for each shareholder safe income calculation

- Safe income on hand adjustments per shareholder to support unique scenarios (e.g. preferred cumulative dividends)

- Opening and ending balances for each shareholder safe income on hand calculation by tax year

- Flexibility to change shareholder percentages of safe income on hand earned each year

- Safe Income on hand calculation summary by shareholder