Salary vs Dividend

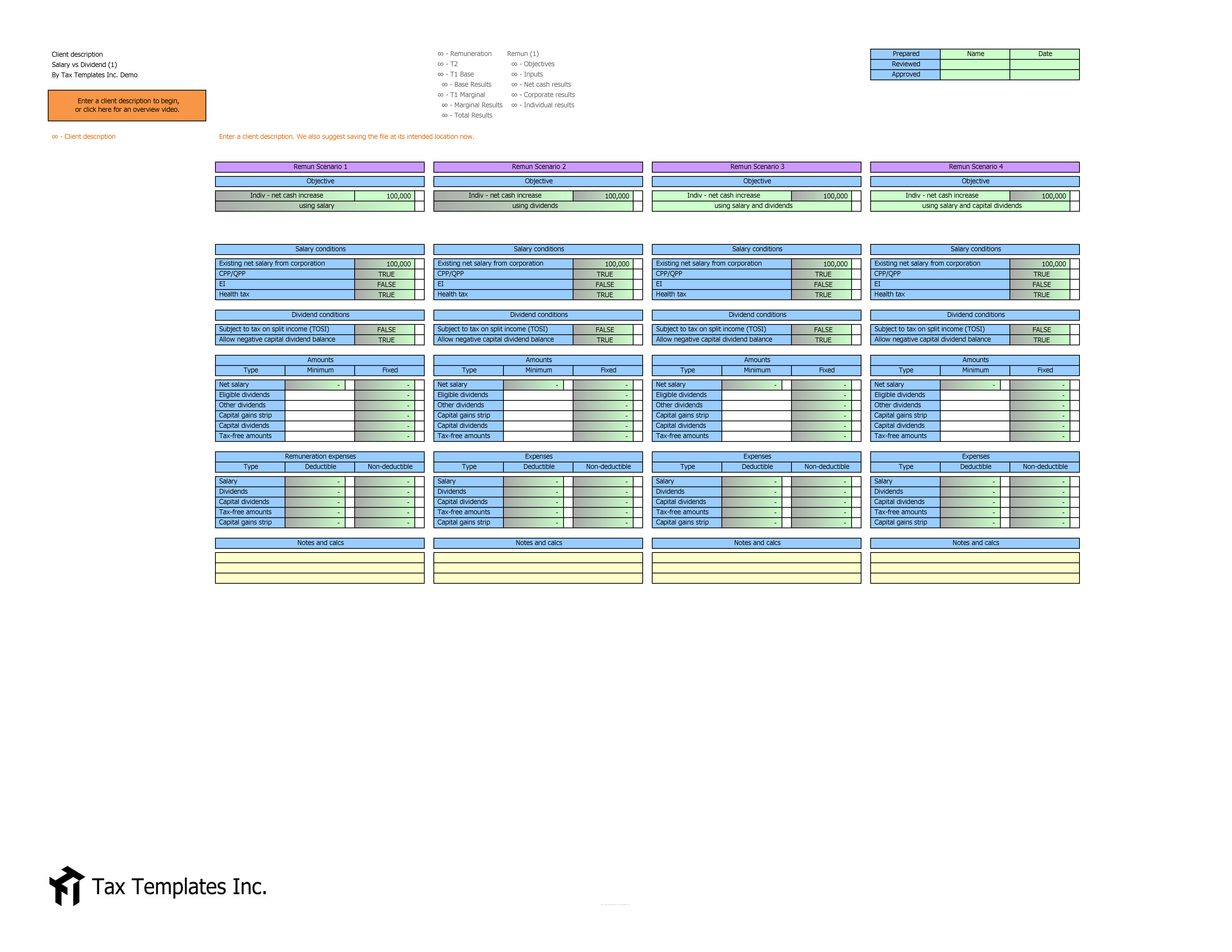

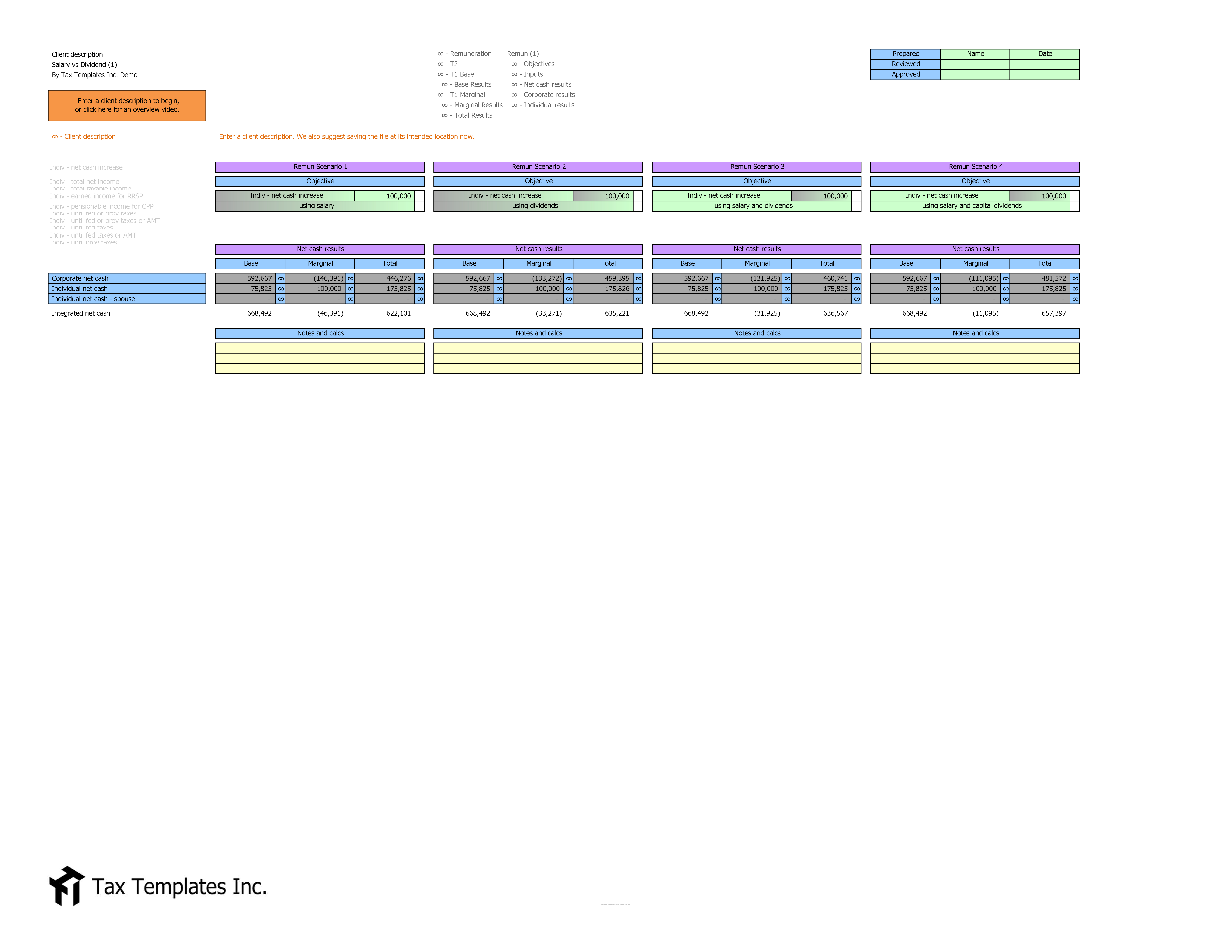

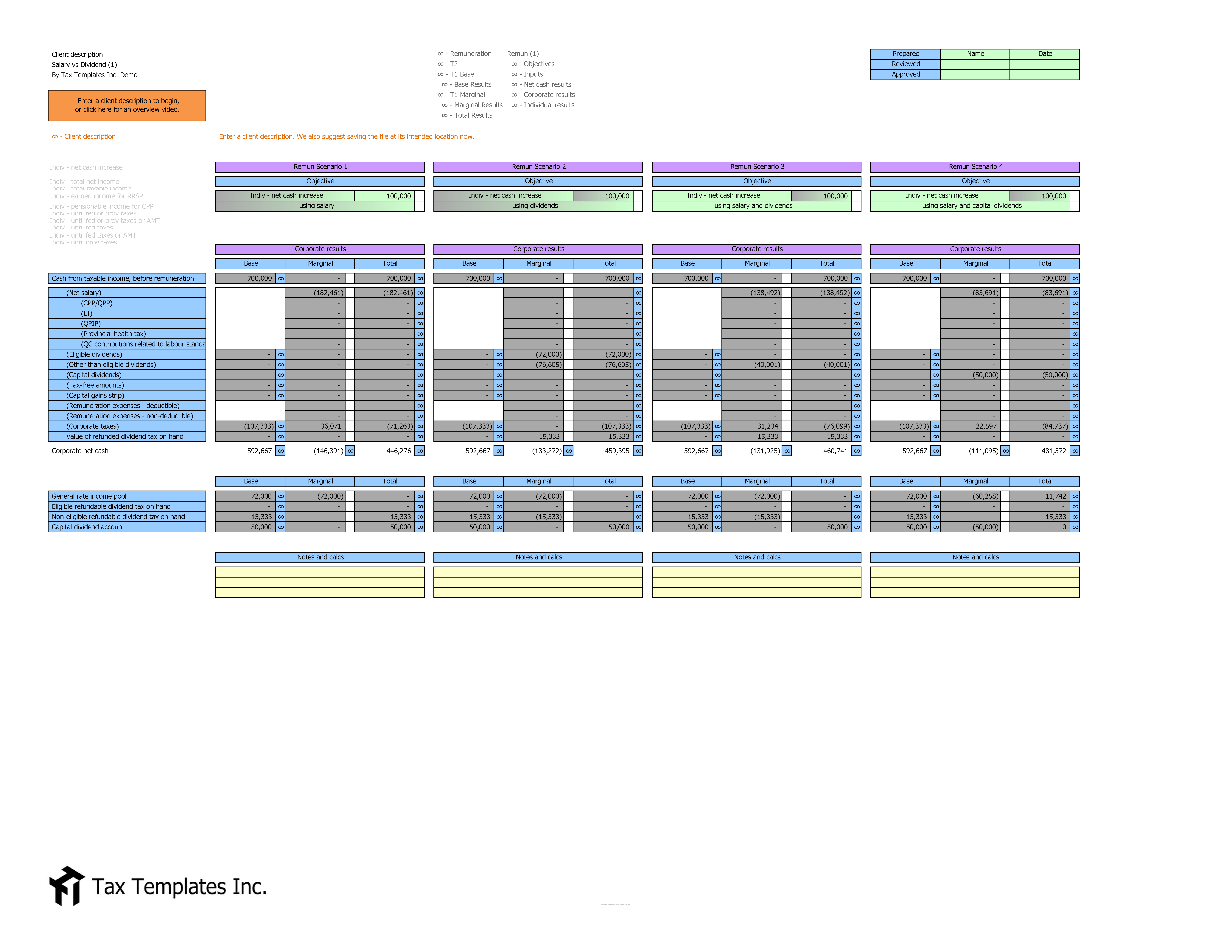

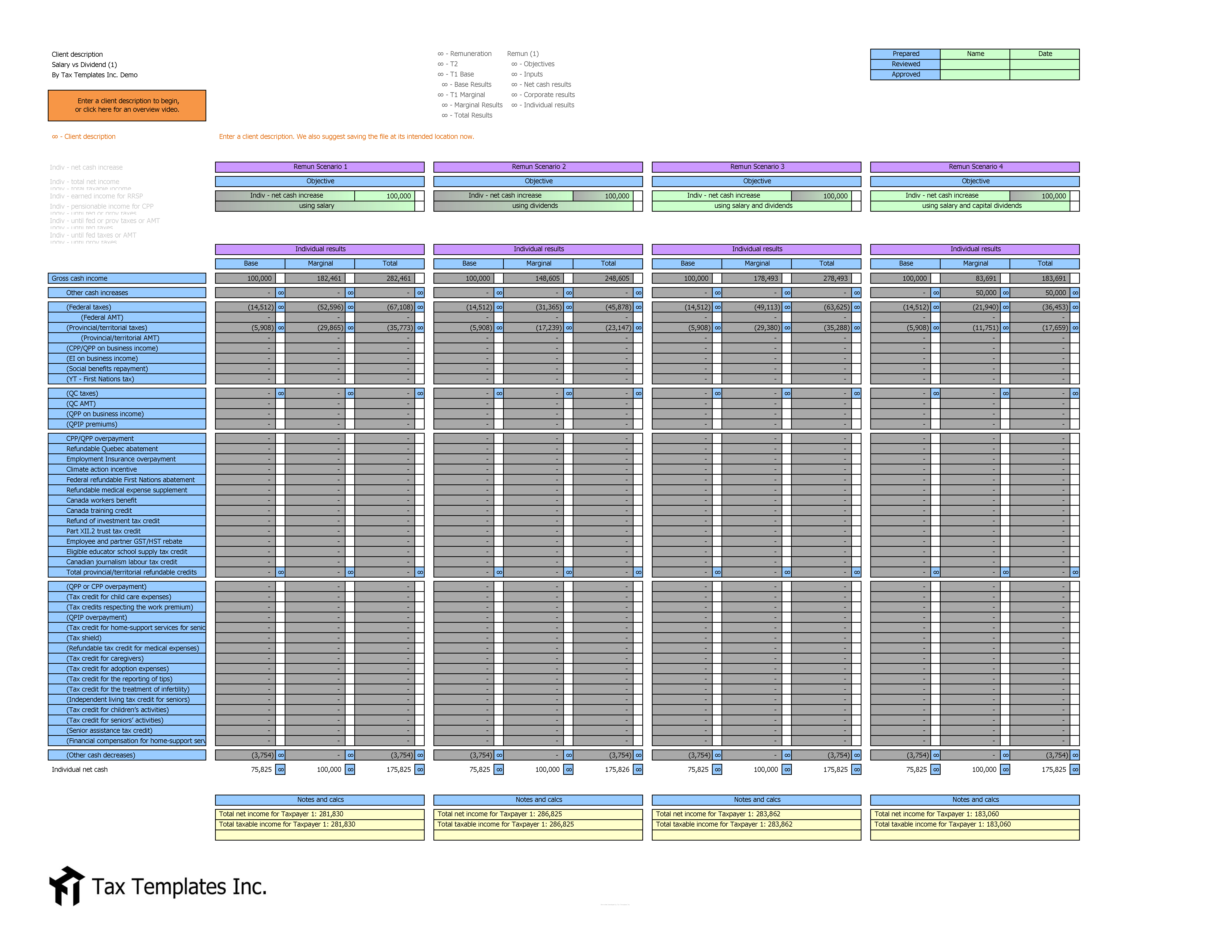

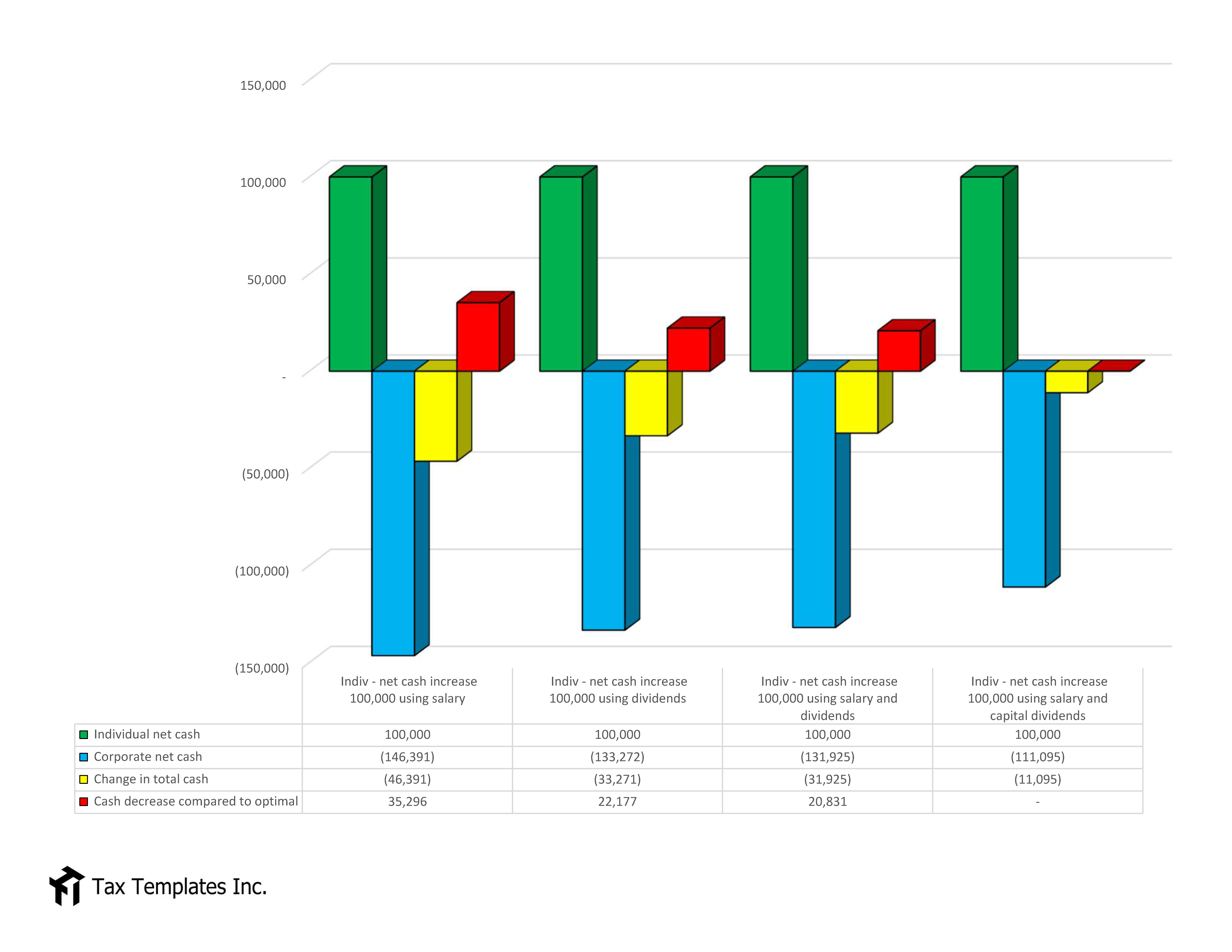

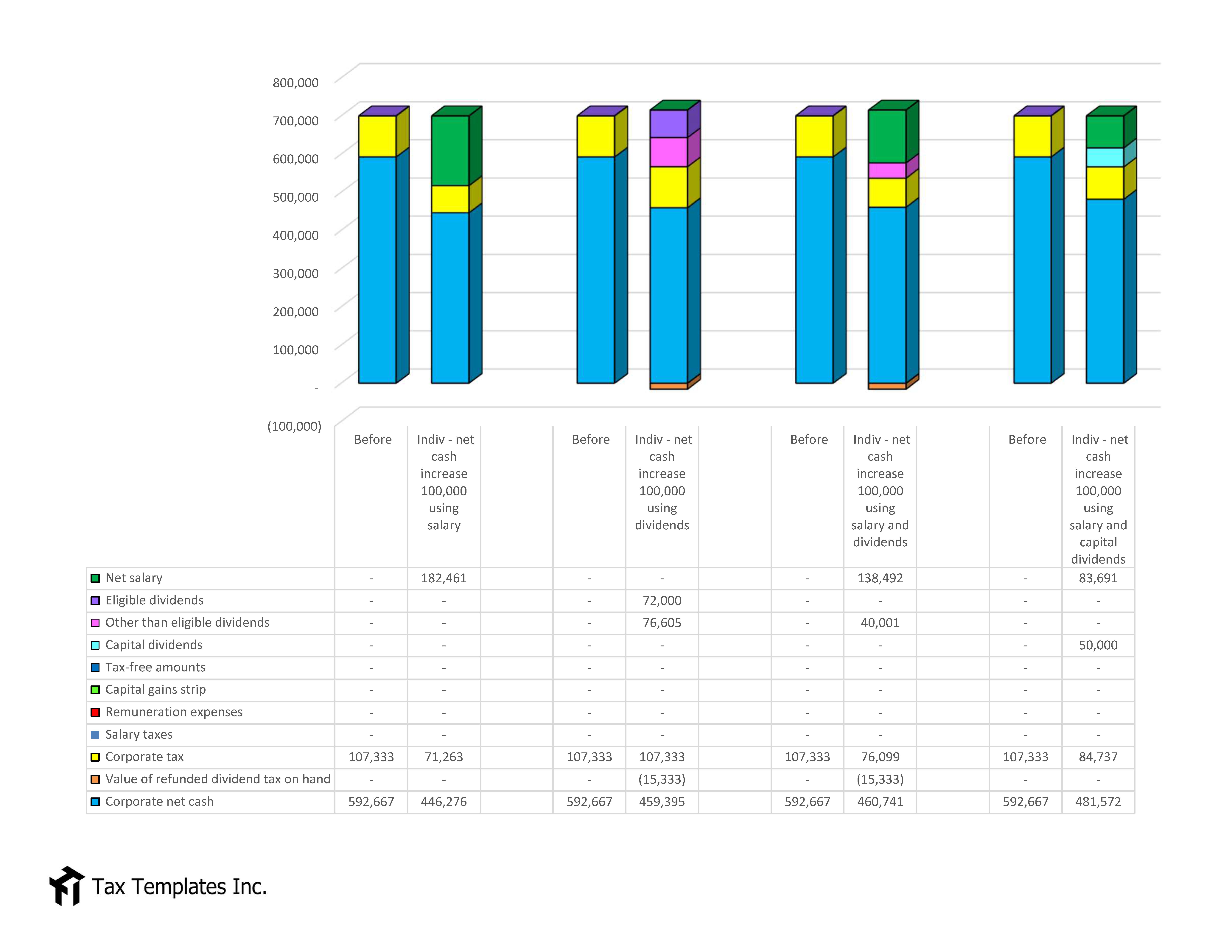

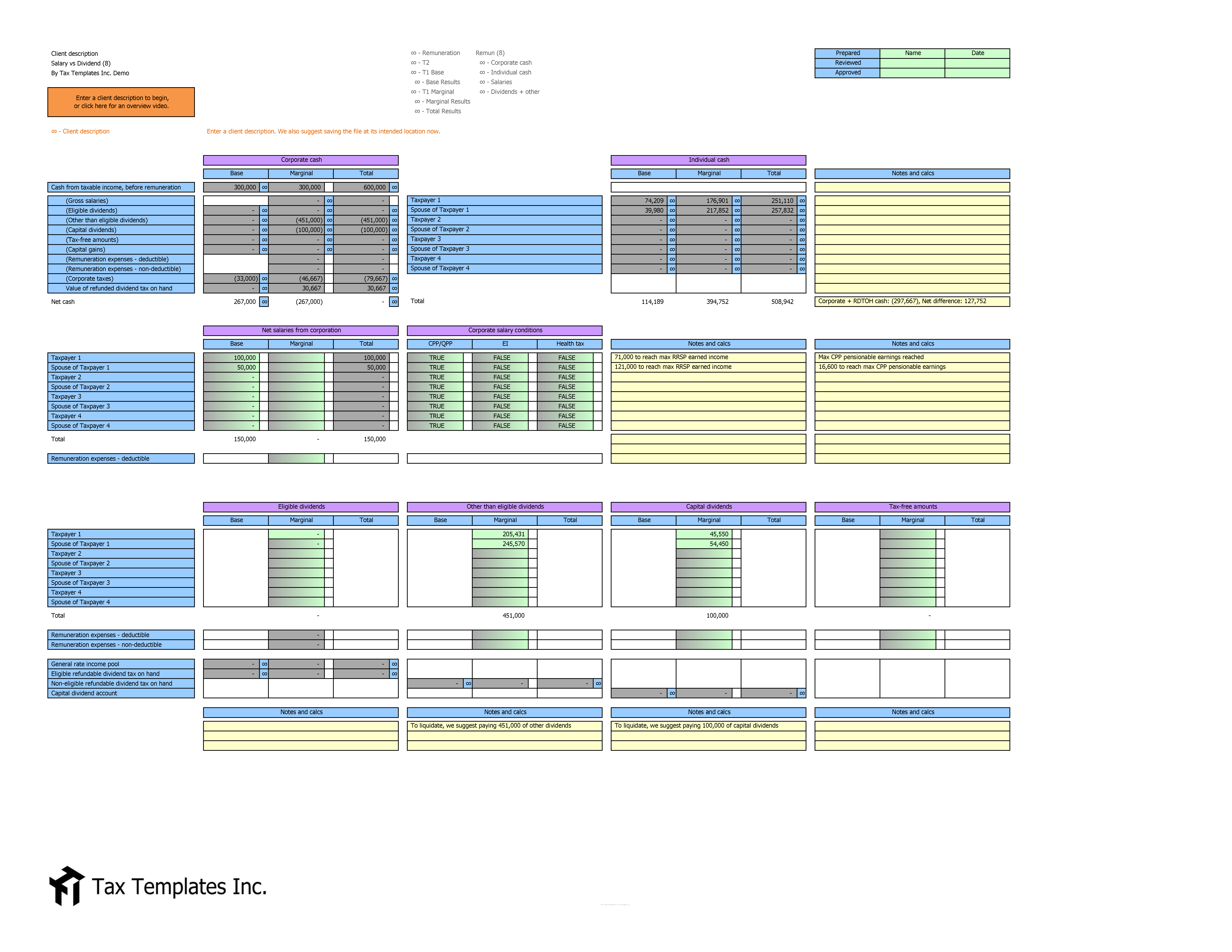

Canada's leading tool to optimize corporate remunerationThese worksheets optimize the integrated corporate and personal cash outcomes of remuneration strategies using salary, eligible dividends, other-than-eligible dividends, capital dividends, or a capital gains strip.

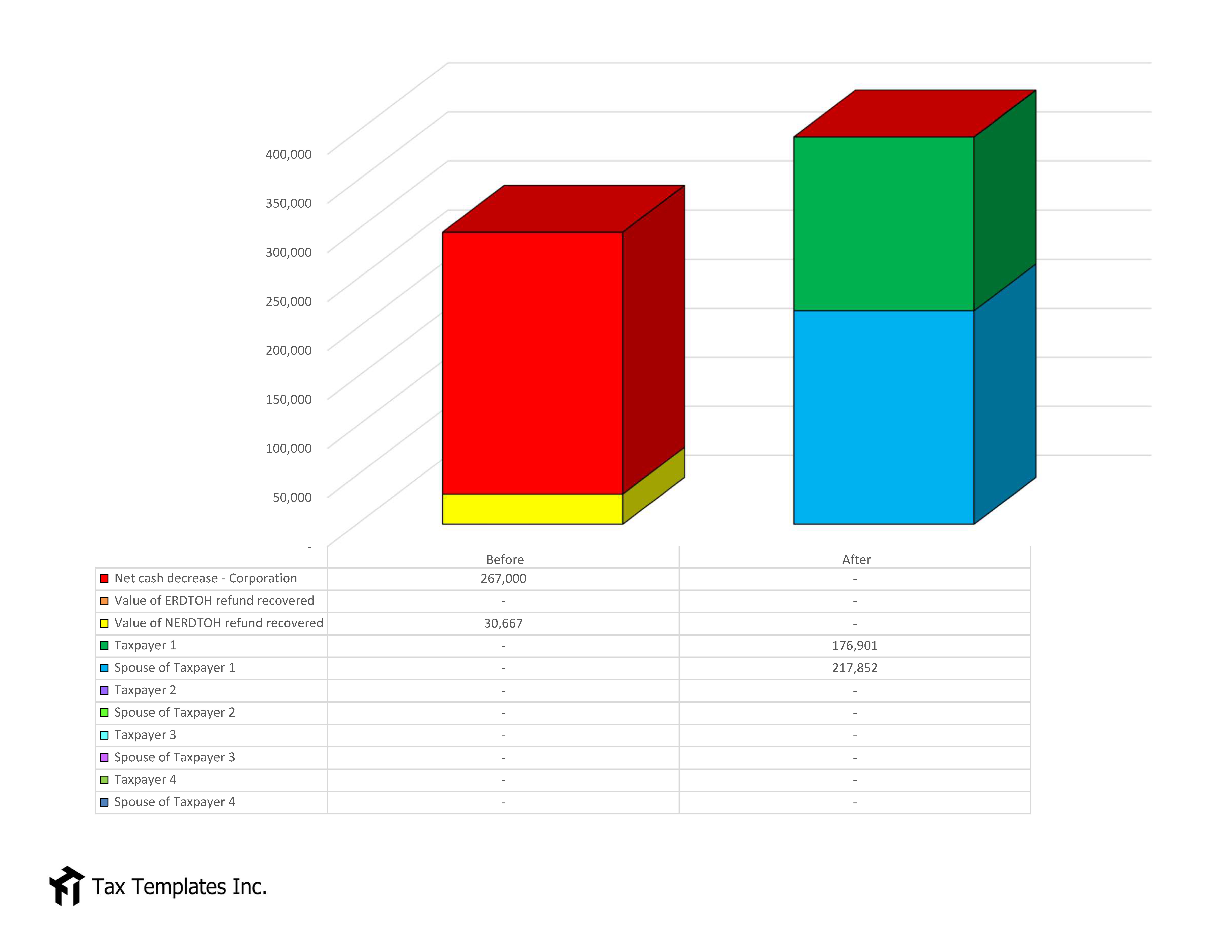

The worksheets provide the tax and cash results, before and after, for both the corporation and the shareholder(s) included. They support many corporate tax details such as NERDTOH, ERDTOH, GRIP, and AAII, along with accurately quantifying many corporate costs such as CPP, EI, employer health taxes, and fees.

The worksheets also support personal tax details such as the Capital Gains Exemption, TOSI, carry-forwards balances such as RRSPs and donations, clawbacks of transfer payments such as CCB and OAS, and TTI’s proprietary optimization algorithms to maximize net cash

Salary vs Dividend (for 1)

This worksheet finds optimal answers with respect to many different objectives and planning strategies, including:

-

Target net cash to efficiently clear shareholder debit balances, or fund a lifestyle/purchases

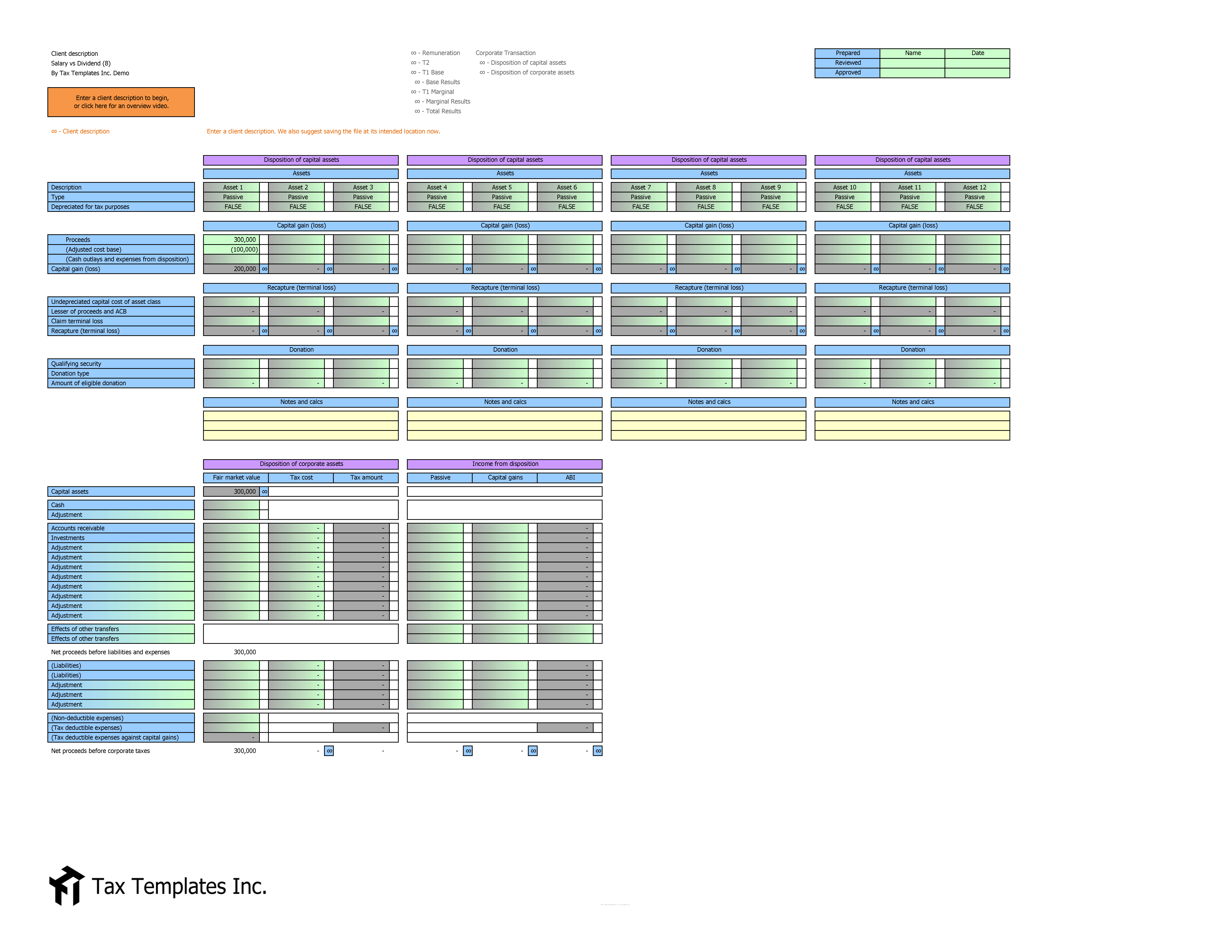

- Liquidate a corporation, including after a selling a key corporate asset or a full corporate asset sale

- Determine net after-tax cash from selling shares vs selling assets

-

Target specified individual net income to hit specific tax brackets, access government benefits, or meet credit covenants

-

Pay “until personal taxes apply” federally, provincially, or combined to maximize tax-free payments or avoid AMT

-

Target key income thresholds for RRSP and CPP purposes, or until the taxpayer’s OAS starts being clawed back

-

Target specified corporate net income, taxable income, and SBD thresholds for bonusing down decisions or AAII considerations

-

Extract all corporate cash, or just enough to utilize all RDTOH balances

-

Pay amounts until the tax cost to the individual exceeds the tax cost to the corporation

- Determine whether it is more tax efficient to earn different types of income through a corporation, or personally

-

Calculate the tax deferral available based on the after-tax cash needs of an individual

Salary vs Dividend (for 2 to 8)

This worksheet determines strategic amounts of either salary or dividends and the ideal allocation over two shareholders to maximize the after-tax cash of married or common-law individuals, or unrelated individuals, including:

-

Target a specified amount of cash from the corporation

- Liquidate a corporation, including after a selling a key corporate asset or a full corporate asset sale

- Determine net after-tax cash from selling shares vs selling asset